The personal budget software market is witnessing a surge in popularity as individuals and families increasingly seek efficient ways to manage their finances. With the growing reliance on digital tools in everyday life, budgeting software has emerged as an essential component in achieving financial wellness. These applications help users track income, monitor expenses, set savings goals, and make informed decisions. Unlike traditional spreadsheets or paper-based budgeting methods, personal budget software offers automation, real-time updates, and customizable features that cater to a wide range of financial goals.

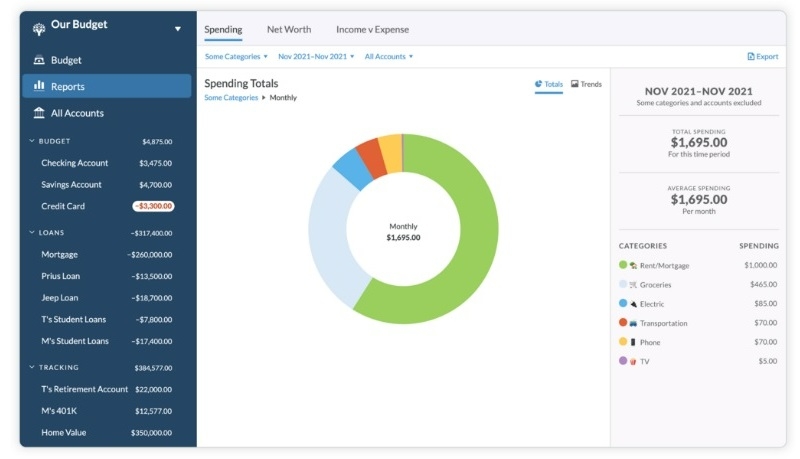

In an era where financial literacy is becoming more important, personal budgeting tools empower users to take control of their money. Rising living costs, fluctuating income patterns, and economic uncertainty have driven individuals to adopt smarter money management strategies. Budgeting software simplifies this process by consolidating financial data into user-friendly dashboards. Users can categorize expenses, schedule bill payments, and receive alerts about overspending. The ability to sync with bank accounts and credit cards makes the tracking seamless and reduces manual errors.

Get a sample PDF of the report at –

https://www.wiseguyreports.com/sample-request?id=655941

Modern budget management apps come equipped with a variety of features that make them appealing to a broad audience. Automation is one of the top functionalities—users can automate savings, schedule recurring payments, and receive timely reports. AI-driven insights and predictive analytics help users understand spending habits and adjust accordingly. Customizable budget categories, debt payoff calculators, and savings goal tracking enhance usability. The integration of mobile accessibility ensures that users can manage finances on the go, a key selling point for today’s fast-paced lifestyles.

The benefits of using personal budget software extend beyond tracking expenses. These tools encourage a disciplined approach to money by helping users set realistic goals and stick to them. Financial stress is significantly reduced when individuals have a clear understanding of their cash flow and obligations. Budgeting apps also foster better saving habits, making it easier to build emergency funds or save for major purchases. For families, these applications support collaborative financial planning by enabling shared accounts and budgeting goals among household members.

A variety of personal finance software platforms have earned recognition for their effectiveness and ease of use. Applications like Mint, YNAB (You Need A Budget), PocketGuard, and EveryDollar are frequently cited as top contenders. Each offers distinct features: Mint emphasizes expense tracking and credit monitoring, YNAB focuses on proactive budgeting strategies, and PocketGuard highlights overspending prevention. These applications cater to different user needs, from beginners looking for simplicity to experienced budgeters seeking advanced analytics.

Several trends are shaping the evolution of personal budgeting software. Artificial intelligence is enhancing user experience through predictive budgeting and smart recommendations. Cross-platform compatibility allows users to switch between devices without losing data, ensuring continuous accessibility. Subscription-based models are becoming common, offering premium features such as investment tracking or financial coaching. Gamification is another trend, using incentives and achievements to encourage users to stay on top of their budgets.

Personal budget software is gaining traction among various demographics, including millennials, Gen Z, and working professionals. Younger generations are particularly drawn to mobile-first solutions that provide real-time insights and intuitive interfaces. Meanwhile, households and older adults appreciate features like bill payment reminders and debt management tools. The diversity in user needs has prompted developers to offer flexible plans, multi-user support, and even localized financial tools tailored to regional currencies and banking systems.

As budget management apps handle sensitive financial data, privacy and security are top concerns. Leading software providers prioritize encryption, two-factor authentication, and compliance with financial data regulations. Transparency in data usage policies helps build trust with users, encouraging wider adoption. Many platforms offer offline modes and secure cloud backups to ensure that user data is both accessible and protected.

Browse a Full Report –

https://www.wiseguyreports.com/reports/personal-budget-software-market

Beyond individual benefits, personal budget software contributes to broader financial wellness initiatives. By helping users reduce debt, increase savings, and make informed spending choices, these tools support long-term financial sustainability. Financial institutions and educators are also incorporating budgeting apps into their programs to encourage responsible money management across communities. As people become more mindful of their financial habits, the role of digital budgeting tools continues to expand.

The personal budget software market reflects a growing demand for tools that simplify and empower financial decision-making. As technology continues to evolve, these applications will become even more integral to daily life, enabling users to navigate their finances with confidence and clarity. Whether for managing monthly expenses, planning for retirement, or achieving debt-free living, personal finance software is an invaluable ally in the pursuit of financial freedom. As awareness and accessibility increase, the adoption of budget management apps is set to rise steadily in the years to come.

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Sales :+162 825 80070 (US) | +44 203 500 2763 (UK)

Mail: info@wiseguyreports.com