India Geographic Atrophy Market Overview

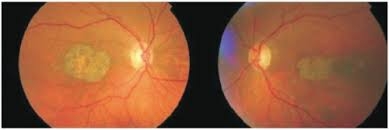

The India Geographic Atrophy (GA) market is steadily emerging as a critical area within ophthalmology, driven by the rising geriatric population and increasing awareness regarding age-related vision disorders. Geographic Atrophy is an advanced form of dry age-related macular degeneration (AMD), resulting in the progressive degeneration of the retinal pigment epithelium, leading to irreversible loss of central vision. While this condition has historically lacked targeted treatment options, recent advancements in diagnostics, research, and therapy development are beginning to shape a more optimistic outlook for patients in India.

Geographic Atrophy remains underdiagnosed in India due to limited access to specialized diagnostic tools in rural areas and a general lack of awareness. However, as India moves toward strengthening its healthcare infrastructure and expanding reach through telemedicine and AI-based screening, the market is expected to experience accelerated growth. Urban hospitals and eye care centers are already witnessing an uptick in GA cases, attributed to increased routine eye screenings among the elderly and a better understanding of early-stage symptoms.

The India Geographic Atrophy market is projected to grow at a notable CAGR over the coming years. Although India currently does not have approved pharmacological therapies for GA, the increasing participation of Indian healthcare institutions in global clinical trials is expected to bring innovative treatments to the domestic market. Additionally, advancements in diagnostic imaging technologies such as Optical Coherence Tomography (OCT) and Fundus Autofluorescence (FAF) are contributing to early detection and improved patient monitoring.

The market can be segmented based on disease stage, diagnostic methods, treatment types, and end-users. By disease stage, GA can be classified into early-stage and late-stage. Late-stage GA dominates the market due to a higher clinical burden and demand for consistent care. However, early detection is gaining traction, especially in urban clinics that are increasingly equipped with advanced diagnostic imaging devices.

In terms of diagnostics, the most commonly used technologies include Optical Coherence Tomography (OCT), Fundus Autofluorescence, Fluorescein Angiography, and Visual Acuity Tests. OCT remains the gold standard for non-invasive, high-resolution imaging, providing detailed visualization of retinal layers and aiding in disease staging. The growing availability of portable OCT machines in India is helping improve access in semi-urban and rural settings.

From a treatment perspective, the market is still focused on supportive and symptomatic care, as disease-modifying drugs for GA have yet to be approved in India. Nutritional supplements, low-vision aids, and anti-oxidative therapies form the current standard of care. However, investigational drugs targeting the complement pathway, neuroprotective agents, and gene therapy are being tested in clinical trials and may soon enter the Indian market through regulatory approvals or compassionate use programs.

The end-user segment includes hospitals, ophthalmology clinics, diagnostic centers, and research institutions. Hospitals and specialty eye care chains dominate the market due to their access to skilled ophthalmologists and advanced diagnostic infrastructure. Clinics in Tier-1 and Tier-2 cities are also seeing increased patient inflow, particularly among the aging population seeking regular eye checkups.

Recent developments in the India Geographic Atrophy market highlight the sector’s growing relevance. Several Indian research institutions have become part of global multicenter clinical trials aimed at testing innovative GA treatments such as complement inhibitors and retinal regenerative therapies. These developments are positioning India as both a key research destination and a future market for novel GA therapies.

AI-powered diagnostic tools are gaining traction, with Indian startups and med-tech firms developing software that can analyze retinal images for early signs of Geographic Atrophy. These tools are especially beneficial in remote regions where access to ophthalmologists is limited. Mobile screening units equipped with fundus cameras and AI algorithms are now being deployed across various states to support mass screening efforts.

Government initiatives such as Ayushman Bharat and the National Programme for Control of Blindness are providing critical support for eye health in the elderly. These programs are expanding access to screenings and subsidized treatments, particularly for economically disadvantaged groups. Several state governments are also investing in tele-ophthalmology platforms to increase coverage and enable remote consultations for age-related macular conditions.

Key companies operating in the Indian GA landscape include a mix of domestic pharmaceutical firms, multinational biotech companies, and med-tech innovators. Sun Pharmaceutical Industries is expanding its ophthalmology portfolio and exploring opportunities in the retinal disease segment. Dr. Reddy’s Laboratories is focusing on supplement-based interventions and partnerships in ophthalmic research. International players like Roche and Regeneron are conducting clinical trials in India for promising investigational drugs such as complement C5 inhibitors and RNA-based therapies.

Browse In-depth Market Research Report ➤➤➤ https://www.marketresearchfuture.com/reports/india-geographic-atrophy-ga-market-51672

Companies like Intas Pharmaceuticals and Cipla are actively investing in eye health R&D and diagnostics. Several technology firms are also contributing to this space by developing imaging software and diagnostic platforms tailored to Indian clinical needs. Moreover, contract research organizations (CROs) in India are collaborating with global pharmaceutical companies to accelerate clinical trials and streamline regulatory processes.

The key market drivers for the India Geographic Atrophy sector include the aging population, increased awareness of eye health, technological advancements in diagnostic imaging, expansion of clinical trial capabilities, and supportive government policies. With over 300 million Indians projected to be over 60 years old by 2050, the burden of age-related vision loss is expected to grow significantly. This will lead to a corresponding rise in demand for effective screening, diagnosis, and treatment of conditions like GA.

Awareness campaigns by healthcare providers and NGOs are playing a crucial role in educating patients and caregivers about the importance of early diagnosis. At the same time, the rising adoption of AI and telemedicine is improving accessibility and reducing diagnosis time, especially in rural and underserved regions.

Regionally, the market is more developed in Southern and Western India, where leading institutions like Aravind Eye Care System and Sankara Nethralaya are conducting research, offering specialized care, and collaborating with global organizations. States like Maharashtra, Karnataka, and Tamil Nadu are leading in terms of both infrastructure and patient volume. In contrast, Northern and Eastern regions are still developing but are beginning to see increased activity due to government interventions and private sector investment.

Explore MRFR’s Related Ongoing Coverage In Healthcare Domain:

Asia Pacific Orthopedic Biomaterial Market