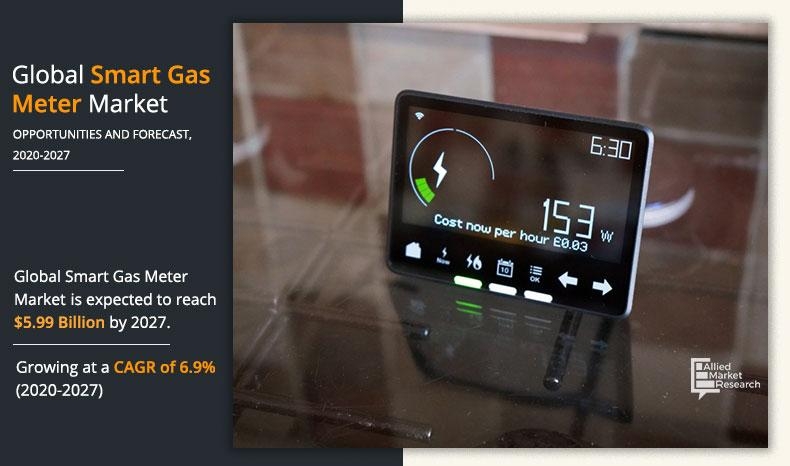

Allied Market Research, titled, “Smart Gas Meter Market by type, component, and end use: Opportunity Analysis and Industry Forecast, 2020–2027” the global smart gas meter market size was $3.71 billion in 2019, and is projected to reach $5.99 billion by 2027, to register a CAGR of 6.9% during the forecast period. North America is expected to be the leading contributor to the global smart gas meter market, followed by Europe and Asia-Pacific.

Smart gas meters are the electronic devices that measures gas flows and the consumption of the gas, and provide information of how much gas has been consumed and its relevant costing. Smart gas meters are equipped with the shock and leakage detection system, increasing the safety to a great extent. The smart gas meter installations help gas companies with some major operational advantages including the elimination of noting monthly reading manually, availability of real-time data, and continuous monitoring of pipeline. In addition, government regulations in North America and Asia-Pacific are pushing them toward smart grids and helping them attain top spots in terms of market shares.

Leading companies around the globe increasingly being aware of the technologies and some of the organizations are investing in integrating new technologies to produce advanced metering devices with improved performance and efficiency. Due to operational benefits, the adoption of advance metering infrastructure has increased in recent years. These factors are anticipated to create lucrative opportunities for smart gas meter market during the forecast period.

The major factors that drive the smart gas meter market size is supportive government policies, development of communication network infrastructure, and high developments in the field of advanced metering infrastructure. In addition, large scale installations of the smart meters by the utility companies are focusing on strengthening the distribution of the smart gas meters. However, high installation and maintenance cost of smart gas meters borne by end users restrain the growth of the smart gas meter market. Various grid operators and other gas utility providers are effectively managing the demand for smart gas meters. However, various benefits offered by the smart gas meter such as automatic meter reading and bill generation are further expected to contribute toward the growth of the smart gas meter industry.

By region, the smart gas meter market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. The analysis had identified that North America contributed maximum revenue in 2019. The smart gas meter market in Europe is expected to grow at a faster rate as compared to other regions. Factors such as Europe has witnessed the maximum number of rollouts by various countries to enhance their smart gas meter installations. Shifting toward the renewables to achieve long-term green energy target which have increased the smart gas meter installations.

Key Findings Of The Study

- In 2019, the residential segment accounted for the maximum revenue and is projected to grow at a notable CAGR of 7.5% during the forecast period.

- The hardware segment accounted for more than 50.0% of the smart gas meter market share in 2019.

- China as the major shareholder in the Asia-Pacific smart gas meter market accounted for approximately 55.0% share in 2019.

The key players profiled in the report include Honeywell International Inc, Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Sensus, Aclara Technologies, and Apator SA. Market players have adopted various strategies such as product launch, collaboration, partnership, and agreement to expand their foothold in the smart gas meter industry.