The global two-wheeler tire market continues to evolve, driven by the rising demand for personal mobility, expanding urbanization, and rapid technological advancements in tire design and materials. Two-wheelers—encompassing motorcycles, scooters, and mopeds—have long served as an affordable and efficient transportation option across diverse geographic regions. As the automotive landscape transforms, the two-wheeler tire segment plays a pivotal role in shaping both consumer safety and vehicle performance.

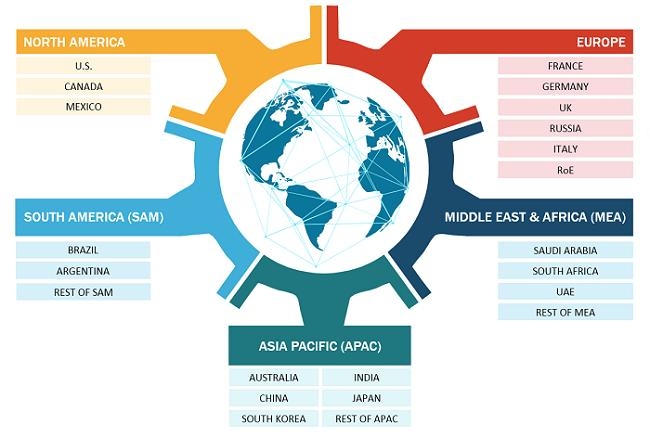

This blog explores the two-wheeler tire market across four key segments: Type (Tube and Tubeless Tires), Distribution Channel (OEM and Aftermarket), Application (Motorcycles, Scooters, Mopeds), and Geography (North America, Europe, Asia Pacific, South and Central America). Let’s dive into how each of these factors contributes to the market’s dynamics and growth opportunities.

Segmentation by Type: Tube vs. Tubeless Tires

Tire technology has evolved significantly in recent years, particularly with the growing preference for tubeless tires over traditional tube-type variants.

-

Tube Tires: Often found on older or more budget-friendly two-wheeler models, tube tires are relatively cheaper and easier to manufacture. However, they tend to be less efficient in terms of heat dissipation and are more prone to sudden deflation in case of punctures. Despite these drawbacks, tube tires still hold relevance in certain regional markets, particularly in rural or developing areas where affordability is key.

-

Tubeless Tires: Tubeless tires are gaining significant traction due to advantages like better safety, improved fuel efficiency, and ease of repair. Their structure allows for slower air leakage during punctures, minimizing the risk of accidents. As manufacturers and consumers alike lean toward performance and safety, the tubeless segment is steadily overtaking tube tires, especially in urban markets and in higher-end two-wheeler models.

Distribution Channel Analysis: OEM vs. Aftermarket

The distribution of two-wheeler tires primarily happens through two channels: Original Equipment Manufacturers (OEMs) and the Aftermarket.

-

OEM Segment: This channel includes tires supplied directly by manufacturers when a two-wheeler is first sold. OEMs maintain stringent quality standards and often collaborate with tire companies to develop model-specific tires. While the OEM segment benefits from consistent demand driven by new vehicle sales, its growth is tied closely to the two-wheeler manufacturing cycle and macroeconomic factors that influence new vehicle purchases.

-

Aftermarket Segment: The aftermarket is a more dynamic and expansive channel, catering to tire replacements, upgrades, and repairs. With tires being wear-and-tear components, their replacement becomes necessary multiple times during a vehicle's lifecycle. This makes the aftermarket segment a significant contributor to overall market volume. The growing awareness around tire maintenance, coupled with a rise in e-commerce and online tire retailers, is further boosting the aftermarket presence globally.

Application Segmentation: Motorcycles, Scooters, and Mopeds

The type of two-wheeler significantly influences tire specifications and market behavior.

-

Motorcycles: Representing the largest segment in terms of market share, motorcycles require high-performance tires tailored to diverse riding conditions—from city commuting to off-road and sports applications. With growing interest in performance bikes, especially in urban and semi-urban regions, demand for durable and technically advanced tires is on the rise.

-

Scooters: Scooters are widely popular in urban areas due to their ease of use, affordability, and low maintenance. Tires for scooters tend to prioritize comfort, fuel efficiency, and grip for short-distance commuting. As cities promote micro-mobility and low-emission vehicles, scooters—including electric models—are becoming more mainstream, contributing to increased tire demand in this sub-segment.

-

Mopeds: While mopeds hold a smaller share of the market, they remain relevant in certain regions, particularly where affordability is a key concern. Their low-speed operation and light design call for tires that offer sufficient durability and value for money. Despite declining use in some developed markets, mopeds continue to be a go-to solution in parts of South Asia and Africa.

Geographic Outlook: Regional Trends and Market Dynamics

Asia Pacific

Asia Pacific dominates the global two-wheeler tire market by a significant margin. The region's leadership is fueled by massive demand from countries like India, China, Indonesia, and Vietnam, where two-wheelers are a primary mode of transport. Factors like population density, traffic congestion, and lower disposable incomes make two-wheelers highly attractive, leading to robust tire demand across both OEM and aftermarket channels.

Additionally, the region's emergence as a manufacturing hub for both vehicles and tires further strengthens its market position. Government initiatives promoting electric two-wheelers are also expected to influence future tire specifications and sales trends.

North America

In North America, two-wheelers are typically used more for recreation or as luxury/performance vehicles rather than everyday commuting. As a result, the market emphasizes premium, high-performance tires with a focus on safety, design, and road grip. While volume is relatively lower than in Asia, average selling prices tend to be higher, driven by consumer preferences for branded and specialized tires.

Growing awareness around motorcycle safety and seasonal tire replacement in colder regions also contribute to consistent aftermarket demand.

Europe

Similar to North America, the European two-wheeler tire market is driven by both practical and recreational usage. Urban centers with traffic congestion and emission regulations are seeing a rise in scooter adoption, especially electric models. Meanwhile, motorcycles remain popular among enthusiasts, creating a demand for high-quality and eco-friendly tires.

Europe is also witnessing innovation in sustainable tire manufacturing and recycling, aligned with the region’s environmental policies and consumer expectations.

South and Central America

This region is characterized by a growing two-wheeler population, especially in countries with inadequate public transportation systems. Affordability and accessibility make two-wheelers a practical choice, driving tire demand. While economic fluctuations and inflation pose occasional challenges, the overall market potential remains strong due to rising urbanization and vehicle ownership.

OEM and aftermarket networks are expanding in the region, and with the increasing availability of international tire brands, consumers are gradually shifting from basic to more durable and efficient tire options.

Future Outlook and Emerging Trends

The two-wheeler tire market is poised for steady growth, supported by a combination of technological, demographic, and economic factors. Key trends shaping the future of the market include:

-

Electrification: As electric scooters and motorcycles gain popularity, tire designs are being adapted to accommodate unique torque and weight distribution patterns.

-

Sustainability: Tire manufacturers are investing in eco-friendly materials and circular economy models, responding to global environmental concerns.

-

Digitalization: Online tire sales platforms and mobile servicing solutions are making it easier for consumers to access tire information, compare options, and schedule replacements.

-

Smart Tires: Integration of sensors for real-time monitoring of pressure and temperature is an emerging area of innovation, particularly in high-end motorcycles.

Conclusion

The two-wheeler tire market is a dynamic and diverse landscape, shaped by technological advancements, regional transportation needs, and evolving consumer expectations. As mobility trends shift and sustainability becomes central, the tire industry is embracing innovation and efficiency. Businesses that understand and respond to these trends—whether by offering high-performance products, tapping into underserved markets, or investing in green technologies—are well-positioned to lead in the years ahead.