The global integrated workplace management system (IWMS) market was valued at USD 4.21 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 13.4% from 2023 to 2030. This growth is primarily driven by the ongoing adoption of digital workplace solutions and the automation of facility management processes. Organizations are increasingly moving away from traditional methods, opting for digital solutions for various functions, including lease management, facilities and space management, asset and maintenance management, and project management. The rising demand for more efficient operational solutions, which is leading to the development of increasingly sophisticated systems and services, is expected to further propel the demand for IWMSs. Additionally, the benefits these systems provide—such as integrated processes, real-time tracking, reduced energy consumption, disaster recovery capabilities, enhanced safety and security, and data center consolidation—are anticipated to significantly contribute to market growth over the forecast period.

The global trend towards adopting advanced technologies, including analytics, sophisticated sensors, Software as a Service (SaaS), and mobile solutions, is fostering demand for enterprise integration. This trend is prompting a broader implementation of IWMS across various organizations. Companies are recognizing the need for greater transparency and insight into their facilities and business processes, along with the associated data. Implementing an IWMS creates a structured and standardized data repository that enhances transparency across all relevant corporate functions. As awareness of the multiple benefits of IWMS grows, demand is expected to rise throughout the forecast period.

Gather more insights about the market drivers, restrains and growth of the Integrated Workplace Management System Market

Offering Insights

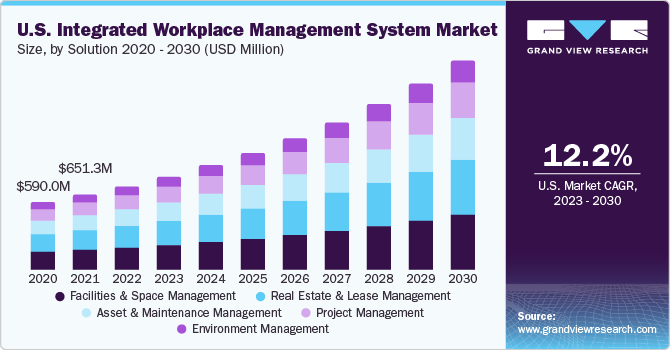

The market is categorized into two main segments: solutions and non-solutions. In 2022, the solution segment held the largest revenue share at 68.2%. This segment is further divided into several areas: real estate and lease management, facilities and space management, asset and maintenance management, project management, and environmental management. Among these, the facilities and space management segment was the leader, accounting for over 28.5% of the market share. This dominance is attributed to the increasing demand for upgrades and maintenance of existing solutions, which enhance decision-making efficiency. Additionally, facilities and space management solutions ensure that administrative and infrastructural support functions are well-aligned to achieve the core objectives of businesses.

Impact of the COVID-19 Pandemic

During the COVID-19 pandemic, the shift to remote work significantly transformed traditional desk jobs. In this new environment, the need for streamlined and automated meeting room bookings and hot-desking functionalities became crucial. This shift is expected to boost demand for facilities and space management solutions that facilitate the booking of meeting rooms. Such solutions enable organizations to monitor space utilization effectively, leading to savings in equipment maintenance and replacement costs by optimizing operational parameters like lighting hours, temperature settings, and fresh-air intake. These factors are projected to enhance the growth of the facilities and space management segment in the coming years.

Service Segment Insights

The service segment is expected to experience the fastest growth, with a projected CAGR of 14.1% during the forecast period. Within the solution segment, it is divided into professional services and managed services, with the professional services segment holding a dominant market share of over 67.1% in 2022. This dominance is driven by the increasing complexity of business operations and the growing adoption of IWMS solutions. IWMS providers offer tailored professional services that include consulting, software implementation, and training to meet industry-specific needs.

For instance, Accruent, a provider of intelligent cloud-based solutions, offers comprehensive training programs through its professional services to enhance client employee effectiveness. Each implementation includes training on product usage and process guidelines tailored to industry and business requirements. Furthermore, the rising demand for third-party support and maintenance services, which are often more cost-effective and provided by skilled technicians, is expected to further accelerate the growth of the professional services segment.

Order a free sample PDF of the Integrated Workplace Management System Market Intelligence Study, published by Grand View Research.