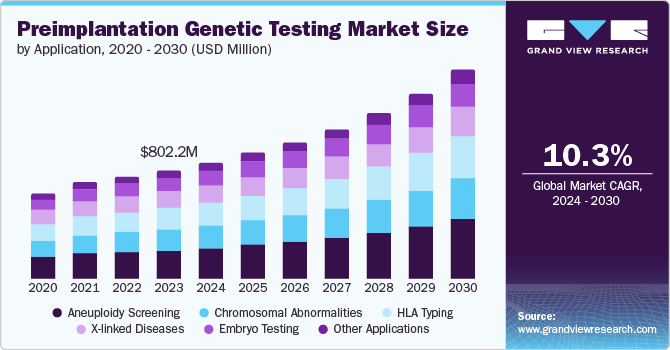

The global preimplantation genetic testing (PGT) market was estimated to be valued at USD 802.2 million in 2023, with projections indicating a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030. This growth is largely driven by the increasing prevalence of single-gene, mitochondrial, and other genetic disorders, which is anticipated to elevate the demand for preimplantation diagnostic and screening processes in the upcoming years. According to the Florida Department of Health, around one in every 33 babies born in the U.S. is affected by a congenital disability, resulting in nearly 120,000 affected infants annually. As new testing options are introduced, demand for these services is expected to rise. For instance, in July 2023, Thermo Fisher Scientific Inc. launched two next-generation sequencing (NGS)-based tests specifically designed for preimplantation genetic testing for aneuploidy (PGT-A).

The integration of aneuploidy screening in preimplantation genetic diagnosis (PGD) has significantly enhanced in vitro fertilization (IVF) procedures. By utilizing aneuploidy testing in IVF centers, healthcare providers can identify embryos with chromosomal abnormalities, which leads to improved pregnancy success rates. Preimplantation genetic testing for aneuploidy (PGT-A) assesses embryos for chromosomal integrity, ensuring they possess the correct number of chromosomes. The benefits of PGT-A—such as higher chances of pregnancy, lower miscarriage rates, and fewer IVF cycles required to achieve a successful pregnancy—are expected to further stimulate the adoption of these tests in the forecast period.

Gather more insights about the market drivers, restrains and growth of the Preimplantation Genetic Testing Market

Industry Dynamics

The preimplantation genetic testing market has experienced considerable innovation, marked by advancements like PGT-A and PGT-M. These developments enhance diagnostic accuracy, mitigate risks, and improve pregnancy success rates, which collectively drive market expansion and deliver better outcomes for individuals dealing with genetic and fertility challenges.

The market landscape is characterized by key players who engage in moderate levels of product launches and merger and acquisition (M&A) activities. Companies are increasingly consolidating their resources to harness advanced technologies, broaden their market presence, and enhance their service offerings. This trend is instrumental in fostering growth and innovation within the sector, ultimately improving outcomes for patients seeking genetic and fertility solutions.

Regulatory frameworks play a significant role in shaping the preimplantation genetic testing market, ensuring that safety, efficacy, and ethical standards are maintained. Stringent regulations govern the development and implementation of testing procedures, thereby building trust among patients and healthcare practitioners. However, the complexity of these regulations can also present challenges for market entry and innovation, potentially affecting the speed of technological advancements.

In terms of alternatives, the preimplantation genetic testing market faces competition from traditional prenatal diagnostic methods, such as amniocentesis and chorionic villus sampling (CVS). Unlike PGT, these conventional methods assess genetic disorders only after pregnancy has been established, which can lead to difficult choices if abnormalities are detected. While these alternatives provide diagnostic options, they do not offer the early intervention advantages that PGT presents.

Order a free sample PDF of the Preimplantation Genetic Testing Market Intelligence Study, published by Grand View Research.