The global chromatography resin market, valued at USD 2.47 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This growth is largely driven by the increasing demand for chromatography techniques across a wide range of industries, including pharmaceuticals, chemicals, food & beverage (F&B), and others. Chromatography resins are crucial in many separation and purification processes, making them indispensable in these industries. Moreover, substantial investments in research and development (R&D) have led to the development of several innovative products, enhancing productivity and performance when compared to traditional resins. As a result, chromatography resins have gained significant market share in recent years due to their high accuracy, ease of use, and reliability in complex applications.

One of the key factors driving market expansion is the growing reliance on chromatography techniques for product analysis, separation, and purification in industries that are scaling up production. In particular, the pharmaceutical industry’s need for chromatography resins has been substantial, as these materials are essential for purifying drugs, especially biologics. The ease of automation and improved precision of newer chromatography resins has made them more attractive for various industrial applications, contributing to the overall market growth.

Gather more insights about the market drivers, restrains and growth of the Chromatography Resin Market

Type Insights

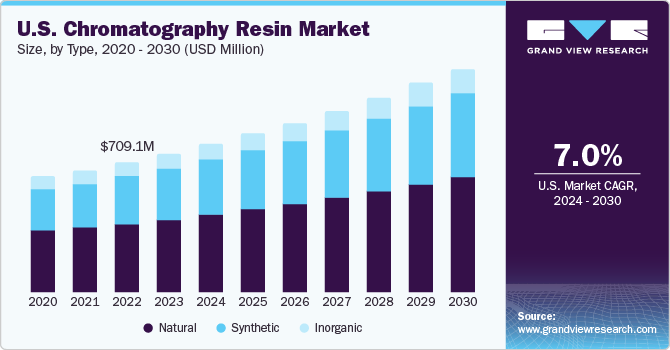

Chromatography resins are available in three primary types: natural, synthetic, and inorganic. Among these, the natural resin segment accounted for the largest market share of 51.1% in 2023. The strong demand for natural resins can be attributed to their widespread use in techniques such as size-exclusion chromatography and paper chromatography. These methods are commonly employed in various industrial applications, including the pharmaceutical, food, and chemical industries. Natural resins are derived from natural sources, and their use offers a more sustainable alternative to synthetic options in certain applications, which is increasingly important in today’s environmentally-conscious market.

In North America, the consumption of natural resins is heavily influenced by the presence of several global pharmaceutical companies, particularly in the U.S. The country has a robust pharmaceutical and biomedical sector, which continues to expand due to rising healthcare expenditures and increasing demand for advanced therapeutic products. As a result, the demand for natural resins, especially in pharmaceutical and biomedical applications, is expected to grow. The U.S. government’s strong focus on R&D investments in the healthcare and pharmaceutical sectors is also anticipated to support the continued growth of natural resins, as these materials are central to many cutting-edge purification and separation technologies.

The synthetic resin segment is expected to witness the fastest growth during the forecast period, driven by its increasing use in ion exchange chromatography. This technique, commonly used in the food & beverage industry, chemicals, pharmaceuticals, petrochemicals, sugar production, and water treatment, relies heavily on synthetic resins for effective ion exchange and purification processes. Synthetic resins, which offer enhanced performance and durability compared to natural resins, are increasingly preferred in industrial applications where higher production rates are needed. This is especially true in industries such as water treatment, where synthetic resins can be used for softening industrial water, removing contaminants, and ensuring the quality of processed water.

In the food and beverage industry, ion exchange chromatography using synthetic resins is used for the purification of sugars, salts, and other additives, while the pharmaceutical industry leverages these resins for the separation of complex molecules during drug development. In the petrochemical industry, synthetic resins are used in the refining processes to purify products, while in water treatment, they help to remove harmful ions and ensure the safety and quality of drinking water. The increasing adoption of synthetic resins in these sectors, due to their superior performance and cost-effectiveness, will significantly contribute to the market’s overall growth in the coming years.

Order a free sample PDF of the Chromatography Resin Market Intelligence Study, published by Grand View Research.