The global hydrogen energy storage market was valued at USD 15.97 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. This growth is primarily driven by the rapid industrialization of developing countries and an increasing global shift toward adopting alternative, more sustainable energy sources. As renewable energy becomes more widely accepted, hydrogen energy storage is seen as a key solution for enhancing energy security and integrating renewable energy into power grids. The U.S. market is expected to experience substantial growth over the forecast period, owing to ongoing research and development (R&D) initiatives and the construction of large-scale hydrogen storage projects. A notable example is the Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST) program, which is part of the initiative led by the Fuel Cell Technologies Office. This program focuses on advancing current and future technologies through research conducted at national labs.

According to the International Renewable Energy Agency (IRENA), for renewable hydrogen to be competitive with hydrogen produced from fossil fuels, its production cost must be less than USD 2.5 per kg. The cost of hydrogen production is influenced by various factors, such as the location of production, market demand, energy tariffs for renewable power, future investments in electrolyzers, and other technological advancements. As the cost of hydrogen production decreases, more energy storage systems will be deployed, driving further growth in the market. Additionally, many key players in the industry are adopting forward integration strategies, integrating hydrogen storage systems with end-use industries like fuel cell vehicles, grid services, and telecommunications, which require stored hydrogen for their operations.

Gather more insights about the market drivers, restrains and growth of the Hydrogen Energy Storage Market

Technology Insights

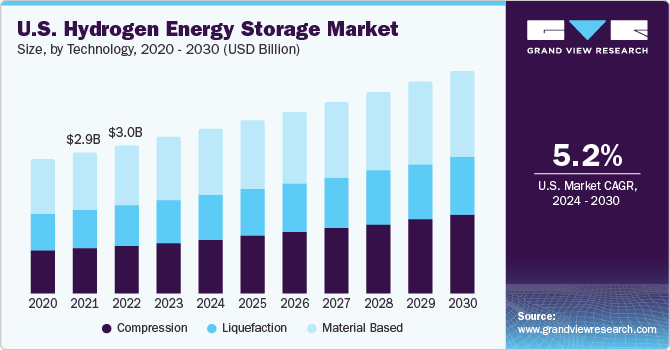

In 2023, the compression storage technology segment held the largest share of the hydrogen energy storage market, contributing over 40.0% of total revenue. This dominance can be attributed to the extensive use of compressed hydrogen across various sectors. Compressed hydrogen is employed in on-site stationary power generation, hydrogen fueling stations, and fuel cell vehicles in the road transportation sector. Additionally, hydrogen compression techniques are commonly used to store hydrogen in cylinders for industrial applications, particularly in manufacturing and chemical industries, where hydrogen is needed in large quantities for chemical processes.

Liquefaction technology is commonly used by bulk industrial gas suppliers like Linde, Air Liquide, and Air Products & Chemicals Inc. to deliver hydrogen in large quantities to industrial end-users, particularly in sectors like oil and gas and the chemical industry. These industries require significant volumes of hydrogen for their manufacturing processes, making liquefaction an essential method for bulk hydrogen supply.

Looking ahead, the material-based storage technology segment is expected to grow at a high rate during the forecast period. This segment includes various advanced hydrogen storage solutions, such as hydride storage systems, liquid hydrogen carriers, and surface storage systems. These storage technologies are gaining traction due to their high volumetric storage density, meaning they can store more hydrogen in a smaller volume compared to traditional methods. Material-based storage also provides enhanced safety and efficiency, making it an increasingly attractive option for large-scale hydrogen storage applications.

Order a free sample PDF of the Hydrogen Energy Storage Market Intelligence Study, published by Grand View Research.