The global molecular cytogenetics market was valued at USD 2.02 billion in 2022, and it is projected to grow at a compound annual growth rate (CAGR) of 10.6% from 2023 to 2030. This substantial growth is driven by several key factors, including the increasing incidence of oncology cases, ongoing technological advancements in chromosome analysis tools, and the growing shift toward personalized medicine. Additionally, the rise in workshops and conferences focused on cytogenetic analysis is accelerating market expansion by fostering knowledge-sharing and technological adoption. For example, in April 2023, the University of Madras organized a hands-on workshop on genomic techniques in clinical diagnostics, which included a focus on cytogenetic analysis. Such events help spread awareness of the latest advancements and encourage greater use of molecular cytogenetics in healthcare and research.

The COVID-19 pandemic has also had a positive impact on the molecular cytogenetics industry, though in unexpected ways. The urgent global need for rapid and accurate diagnostic testing during the pandemic spurred significant advancements in molecular cytogenetics techniques. Researchers and healthcare providers urgently needed faster, more efficient methods for detecting genetic abnormalities linked to COVID-19, which led to the acceleration of genomic testing technologies. This urgency also advanced the development and implementation of cytogenetic methods that could rapidly identify viral mutations and genetic markers in both the virus and its human hosts.

Additionally, the pandemic highlighted the importance of genomic surveillance to track the spread of viruses, including mutations and variants of concern, such as the Delta and Omicron strains of the coronavirus. This has prompted increased investments in molecular cytogenetic research and the development of genomic infrastructure. As a result, the industry has made significant strides in viral genomics and transmission dynamics, which will continue to impact the broader cytogenetics market moving forward.

Gather more insights about the market drivers, restrains and growth of the Molecular Cytogenetics Market

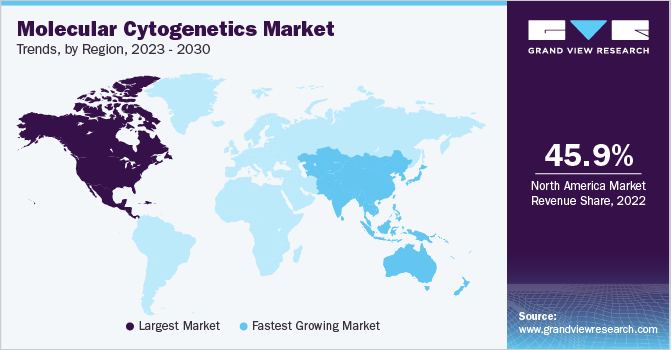

Regional Insights

North America

In 2022, North America held the largest share of the molecular cytogenetics market, with a revenue share of 45.97%. This dominance is primarily attributed to the presence of major local players, such as Agilent Technologies, Inc., alongside the region's advanced healthcare infrastructure. Other key drivers of growth in this region include:

• Increasing research funding: There has been a notable rise in financial support for research in molecular cytogenetics, which has bolstered the development of new technologies and applications.

• Growing awareness of advanced laboratory techniques: As medical professionals and researchers become more aware of cutting-edge diagnostic tools and techniques, the demand for molecular cytogenetic products has risen.

• High incidence of genetic and chronic diseases: The region has a high rate of genetic disorders and chronic diseases, which further drives the need for molecular cytogenetic testing. For instance, according to the CDC, approximately 6,000 babies are born with Down syndrome in the United States every year, emphasizing the need for genetic testing and early diagnosis.

• Regulatory environment: North America benefits from an efficient regulatory framework that supports the administration of genetic tests, creating a favorable environment for market growth. The established standards and regulatory bodies in the region help ensure the quality and safety of products, which contributes to their adoption in clinical settings.

Asia Pacific

The Asia Pacific region is expected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Key factors contributing to the anticipated growth in this region include:

• Economic growth: The steady GDP growth in countries like China and India is expected to significantly improve consumer buying power. As the economic conditions improve, more healthcare investments are likely to flow into the molecular cytogenetics market.

• Workshops and interventions: Various educational workshops, conferences, and training programs in the region are helping to spread knowledge about molecular cytogenetics and advanced diagnostic techniques. These initiatives also foster collaboration and innovation in the field.

• Advancements in disease management: Ongoing improvements in the management of genetic and chronic diseases are encouraging the adoption of molecular cytogenetics. Many countries in the region are making strides in both healthcare infrastructure and disease management technologies.

• Increased awareness: Growing awareness about the importance of advanced therapies and diagnostic tools among the population is anticipated to drive demand. The region is seeing increased attention from both governments and private sector players to improve public health outcomes through better diagnostic solutions.

Browse through Grand View Research's Biotechnology Industry Research Reports.

• The global cancer stem cells market size was valued at USD 2.89 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030.

• The global DNA & gene chip market size was valued at USD 9.96 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030.

Key Companies & Market Share Insights

Several key companies dominate the global molecular cytogenetics market, focusing on strategic initiatives such as expansion, the development of innovative medical devices, and technological advancements. Partnerships, mergers, and acquisitions are common strategies used to enhance product offerings and expand market presence. For example, in June 2023, Oxford Gene Technology (OTG) entered into a partnership with Applied Spectral Imaging (ASI) to enhance OTG’s cytogenetic imaging and analysis solutions in Great Britain. This collaboration is expected to improve workflow automation and increase efficiency, enabling quicker and more accurate diagnostic decision-making.

Key Molecular Cytogenetics Companies

Some of the major players operating in the global molecular cytogenetics market include:

• BIOVIEW

• Danaher

• MetaSystems

• Agilent Technologies, Inc.

• Abbott

• Bio-Rad Laboratories, Inc.

• Illumina, Inc.

• Oxford Gene Technology

• F. Hoffmann-La Roche Ltd

• PerkinElmer Inc.

Order a free sample PDF of the Molecular Cytogenetics Market Intelligence Study, published by Grand View Research.