Market Overview 2025-2033

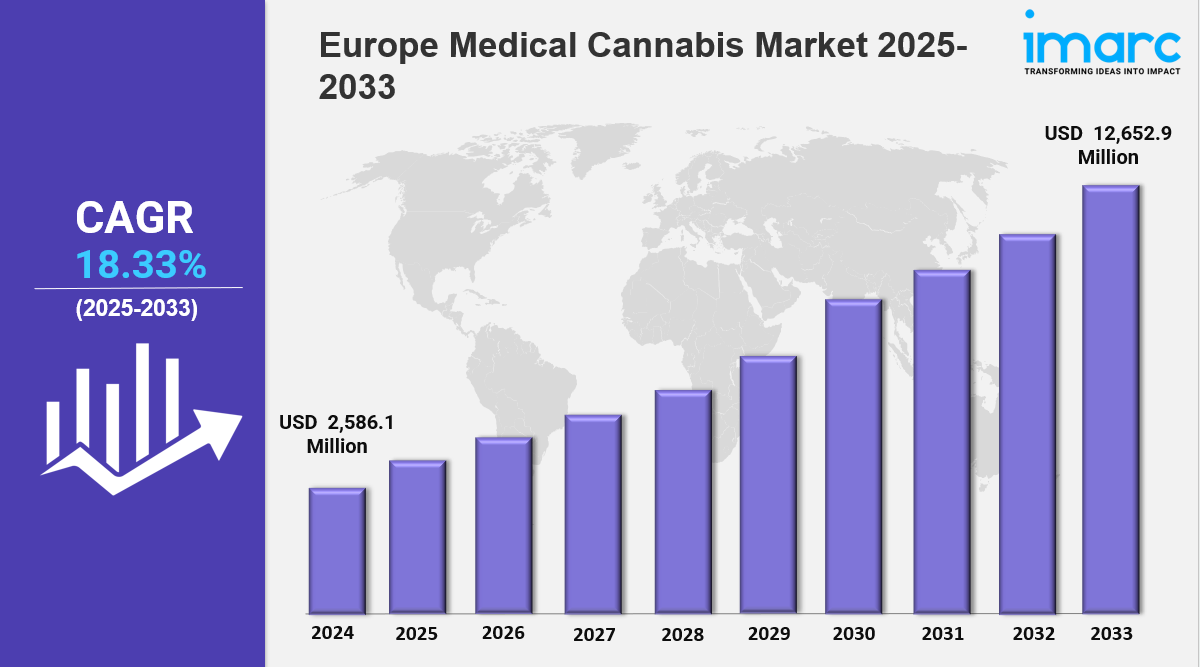

The Europe medical cannabis market size reached USD 2,586.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 12,652.9 Million by 2033, exhibiting a growth rate (CAGR) of 18.33% during 2025-2033. The market is growing due to increasing legalization, rising medical applications, and expanding research initiatives. Innovations in product development, regulatory support, and patient demand are driving expansion, making it a dynamic and evolving industry.

Key Market Highlights:

✔️ Rapid market growth driven by increasing legalization and acceptance of cannabis for medical use

✔️ Rising demand for cannabis-based treatments in pain management, neurology, and oncology

✔️ Expanding research and investment in pharmaceutical-grade cannabis production and innovation

Request for a sample copy of the report: https://www.imarcgroup.com/europe-medical-cannabis-market/requestsample

Europe Medical Cannabis Market Trends and Drivers:

The Europe medical cannabis market is expanding rapidly as more countries embrace its potential to treat a wide range of health conditions. Changing laws and growing public awareness are making medical cannabis more accessible, with nations like Germany, the UK, and Portugal leading the way. Germany, in particular, made headlines in 2024 by fully legalizing medical cannabis for chronic pain and neurological disorders like multiple sclerosis, which sparked a 40% surge in prescriptions.

At the regulatory level, the European Medicines Agency (EMA) has been working to speed up the approval process for cannabis-based treatments like Epidyolex. This move is helping set clearer safety standards and create more consistency across Europe. Still, not every country is moving at the same pace—France and Italy continue to require case-by-case approvals, while Sweden remains extremely cautious about cannabis use.

These uneven regulations have led advocacy groups to push for a more unified legal framework across the EU. Meanwhile, product quality standards are becoming stricter. Licensed growers in countries such as Spain and the Netherlands are now required to meet ISO certification standards, which is helping to raise industry credibility and attract fresh investment. In 2024 alone, the sector saw a 28% rise in investor funding—yet another indicator of growing confidence in the Europe medical cannabis market size.

Patients are increasingly turning to medical cannabis as an alternative to traditional medications, particularly for chronic pain, anxiety, PTSD, and neurological issues. A 2024 survey found that 62% of respondents with anxiety or PTSD reported improvements after using CBD-based treatments. As Europe’s population continues to age—projected to be over 22% aged 65 and older by 2030—demand for these alternatives is expected to climb.

Germany is setting a strong example by covering medical cannabis under public health insurance for elderly patients with chronic pain, benefiting over 1.2 million people in 2024. Younger demographics are embracing cannabis, too, especially for conditions like ADHD. Platforms such as Algea Care reported a 55% increase in patients under 35 last year. Pharma companies are responding: Jazz Pharmaceuticals rolled out Sativex® in Spain and Poland to support patients with multiple sclerosis.

Still, one of the biggest challenges is keeping up with demand. In 2024, while EU cultivation licenses increased by 15%, demand surged by 34%, leading to a reliance on imports from countries like Canada and Israel. Cross-border partnerships are becoming more common—UK-based Curaleaf acquired Aurora Europe to expand its footprint across Germany, Austria, and Switzerland. Similarly, Danish producer Stenocare joined forces with Poland’s Herbionica to scale production by 2026.

Scientific research is also picking up. A collaborative study between the University of Leiden and Canadian firm Tilray examined the effects of cannabis on chemotherapy-induced nausea, and the findings may shape future EU health guidelines. Online healthcare platforms are playing a key role too, with sites like Cannify and Vayamed helping patients connect with doctors. In Italy and Greece, online consultations related to medical cannabis rose by a staggering 73% in 2024.

However, pricing remains a concern. In France, some patients are spending as much as €1,200 per month on medical cannabis, while the same treatment costs just €300 in the Netherlands. These disparities are pushing some patients toward unregulated markets, raising safety concerns. Looking ahead, the Europe medical cannabis market forecast remains optimistic. Analysts expect the Europe medical cannabis market size to surpass €4.1 billion by 2027. Inflation and rising operational costs—up 18% in 2024—are creating hurdles for smaller growers, but sustainability is offering a path forward. Dutch producer Bedrocan, for instance, now runs entirely on renewable energy. Patient advocacy groups are also gaining momentum; their campaigns helped secure insurance coverage for medical cannabis in 11 countries last year.

Despite lingering challenges like stigma in parts of Eastern Europe and bureaucratic delays at borders, the market is moving forward. Advances in digital health tools and personalized treatments—possibly powered by AI—are expected to play a big role in the coming years. With innovation, growing demand, and increasing acceptance, the Europe medical cannabis market share is poised for continued growth and transformation.

Europe Medical Cannabis Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Species:

-

Indica

-

Sativa

-

Hybrid

Breakup by Derivative:

-

Cannabidiol (CBD)

-

Tetrahydrocannabinol (THC)

-

Others

Breakup by Application:

-

Cancer

-

Arthritis

-

Migraine

-

Epilepsy

-

Others

Breakup by End Use:

-

Pharmaceutical Industry

-

Research and Development Centers

-

Others

Breakup by Route of Administration:

-

Oral Solutions and Capsules

-

Smoking

-

Vaporizers

-

Topicals

-

Others

Breakup by Country:

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145