Tire Retreading Market Size, Growth, Trends and Forecast 2025–2032

Tire Retreading Market Overview

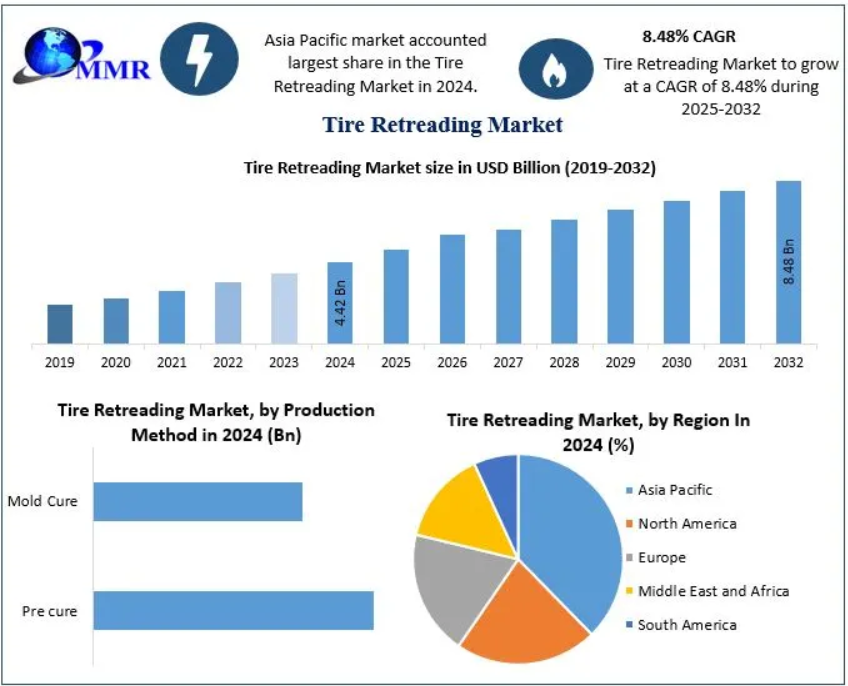

The Tire Retreading Market size was valued at USD 4.42 billion in 2024, and the total revenue is expected to grow at a CAGR of 8.48% from 2025 to 2032, reaching nearly USD 8.48 billion by 2032.

Tire retreading is a process that gives used tires a second life by replacing the worn tread with new rubber, significantly extending tire lifespan and reducing costs for fleet operators. It represents a symbol of the circular economy, as it reduces raw material consumption, decreases energy usage compared to producing new tires, and minimizes waste.

Modern retreading techniques ensure performance, durability, and safety comparable to new tires, making it an increasingly attractive option in the commercial and transport vehicle sectors. With growing emphasis on sustainability, cost optimization, and supply chain efficiency, tire retreading is gaining global traction.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/81491/

Tire Retreading Market Dynamics

Drivers

- Growth in Automotive Production and Vehicle Parc

Rising global automotive production, particularly in emerging economies, fuels the demand for retread tires. As fleets expand, operators turn to retreading as a cost-effective solution compared to new tire replacement. - Cost Savings for Fleet Operators

Retreaded tires cost 30–50% less than new tires, making them a preferred option for commercial vehicles, especially in logistics, mining, and construction sectors. - Environmental Benefits

Retreading saves millions of liters of crude oil annually and reduces landfill waste, aligning with sustainability goals and circular economy principles.

Restraints

- Consumer Perception & Quality Concerns

In some markets, passenger vehicle owners still perceive retreaded tires as less safe or less aesthetic compared to new tires. - Competition from Low-Cost New Tires

In regions where low-priced new tires dominate (particularly from certain Asian manufacturers), retread adoption faces challenges.

Opportunities

- Sustainability Policies in Europe & North America

Regulations mandating the use of eco-friendly solutions in public transport fleets are driving adoption of retreaded tires. - Technological Advancements

New methods in pre-cure and mold-cure retreading enhance tire performance, durability, and appearance, boosting consumer confidence.

Tire Retreading Market Segment Analysis

By Production Method

- Pre-Cure Retreading – Most widely used method, offering flexibility, cost savings, and improved performance consistency.

- Mold-Cure Retreading – Preferred for large fleets and heavy-duty vehicles due to uniform appearance and sidewall branding.

By Vehicle Type

- Passenger Vehicles – Growing adoption as OEMs recognize retread potential and sustainability benefits.

- Commercial Vehicles – Dominant segment, driven by high demand in trucks, buses, and heavy-duty fleets, where cost optimization is critical.

Tire Retreading Market Regional Insights

- Asia-Pacific – Expected to dominate the market during the forecast period. India is a leading hub, where retreading saves hundreds of millions of liters of crude oil annually. Demand is driven by commercial vehicles such as trucks and buses, rising tire costs, and expanding transport industries.

- Europe – Strong focus on sustainability. Countries like Germany and France have mandated evaluation of retreaded tires in public fleets. Retreaded tires are becoming essential to achieving EU climate goals.

- North America – Growth driven by cost savings for large logistics fleets, with significant adoption in the U.S. trucking industry.

- Latin America & Middle East – Emerging markets, with adoption fueled by rising automotive ownership and cost-sensitive transport sectors.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/81491/

Tire Retreading Market Competitive Landscape

The market is fragmented, with global tire manufacturers, specialized retread companies, and regional players competing. Key strategies include expansion of retreading plants, sustainability initiatives, and partnerships with fleet operators.

Key Players

- Bridgestone Corp.

- Michelin SCA

- Valley Tire Company

- Parrish Tire Company

- TreadWright

- REDBURN TIRE COMPANY

- Oliver Rubber Company

- The Goodyear Tire and Rubber Co.

- Marangoni S.p.A

- Michelin North America Inc.

- Kraiburg Austria GmbH & Co.Kg

- Pilipinas Kai Rubber Corporation

- Easters Treads

- JK Tyres

- MRF Tyres

- Yokohama Rubber Co.

- Rosler Tech Innovators

- Tyresoles

Tire Retreading Market Key Highlights

- Market size in 2024: USD 4.42 Bn

- Forecast market size by 2032: USD 8.48 Bn

- CAGR (2025–2032): 8.48%

- Segmentation: By Production Method, Vehicle Type, and Region

- Key Regions: Asia-Pacific, Europe, North America

- Competitive Landscape: Global and regional players including Bridgestone, Michelin, Goodyear, and Marangoni

Conclusion

The Tire Retreading Market is set for strong growth as industries and governments worldwide push for sustainability, cost efficiency, and circular economy adoption. While commercial vehicles will remain the dominant segment, passenger car retreads are gaining acceptance, especially in markets focused on reducing environmental impact.

Asia-Pacific, led by India and China, dominates the industry, while Europe and North America continue to expand adoption through regulatory support and fleet integration. Technological advancements in retreading methods will further enhance performance and consumer trust, solidifying the market’s growth trajectory through 2032.