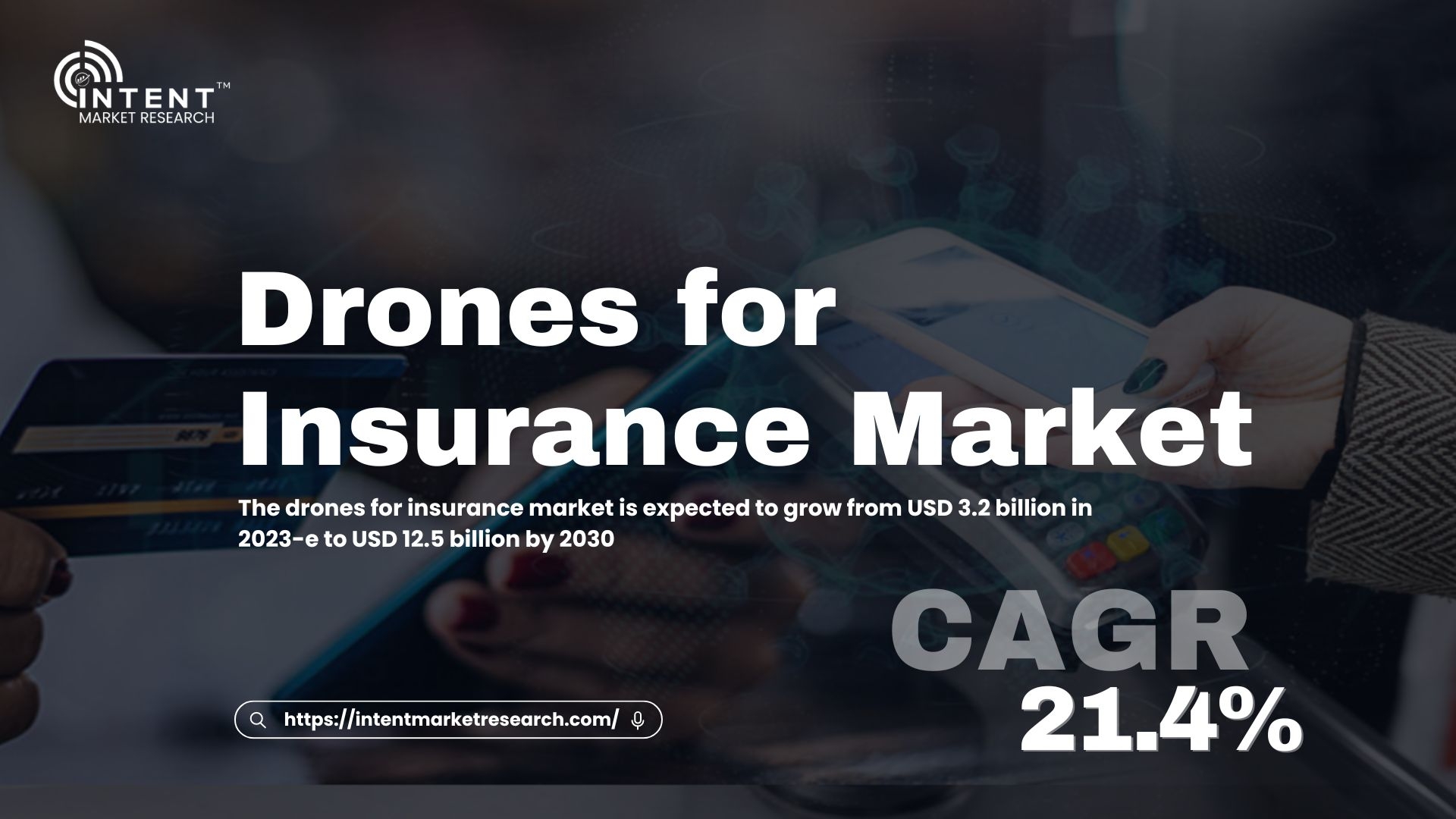

The insurance industry is undergoing a dramatic transformation, and at the heart of this evolution is the adoption of drone technology. The Drones for Insurance Market is projected to grow significantly, expanding from USD 3.2 billion in 2023 to an impressive USD 12.5 billion by 2030, reflecting a robust CAGR of 21.4% during the forecast period. But what does this growth mean for the industry, and how are drones reshaping insurance practices? Let’s dive into this exciting landscape.

Understanding the Role of Drones in Insurance

Drones, also known as unmanned aerial vehicles (UAVs), have gained traction in various industries, but their application in insurance is particularly noteworthy. They offer innovative solutions for risk assessment, claims processing, and customer engagement.

Access Full Report @ https://intentmarketresearch.com/latest-reports/drones-for-insurance-market-3023.html

How Drones Are Revolutionizing the Insurance Industry

Risk Assessment and Underwriting

One of the primary uses of drones in the insurance sector is for risk assessment. By utilizing drones, insurers can gather accurate data on properties, which enhances underwriting processes. For example, drones can conduct aerial surveys of residential and commercial properties, providing detailed imagery and measurements that traditional methods may miss. This high-quality data allows underwriters to make informed decisions, reducing the risk of overestimating or underestimating policyholder risks.

Streamlined Claims Processing

Drones have drastically improved claims processing speed and accuracy. Instead of sending adjusters to physically inspect properties after an incident, insurers can deploy drones to capture images and videos of the damage. This technology not only expedites the assessment process but also minimizes the need for human resources, thus reducing operational costs. As a result, policyholders receive faster claim resolutions, enhancing customer satisfaction.

Enhanced Safety and Accessibility

In many cases, insurance claims involve hazardous environments, such as fire-damaged buildings or areas affected by natural disasters. Drones can safely access these hard-to-reach places, providing insurers with valuable data without putting personnel at risk. This capability is especially beneficial for assessing damages in remote or inaccessible regions.

Market Growth Drivers

Increasing Adoption of UAV Technology

The surge in drone adoption across various sectors is a significant driver for the drones for insurance market. As drone technology becomes more advanced and affordable, insurers are increasingly recognizing its potential benefits. Features like real-time data transmission and high-resolution imaging make drones an attractive tool for risk management.

Growing Demand for Efficient Claims Management

Consumers today expect quick and efficient service. The need for rapid claims processing has pushed insurers to adopt technologies that streamline operations. Drones fit the bill perfectly, allowing insurers to enhance their claims management systems significantly.

Regulatory Support and Standardization

As governments and regulatory bodies develop guidelines for drone usage, the barriers to entry are lowering. This regulatory support fosters a conducive environment for insurers to implement drone technology without the fear of legal repercussions.

Challenges Facing the Drones for Insurance Market

Despite the promising outlook, the drones for insurance market faces several challenges that could impact growth.

Privacy Concerns

The use of drones raises concerns about privacy and data security. Insurers must navigate complex regulations and public sentiment surrounding drone surveillance to maintain trust with policyholders. Ensuring compliance with privacy laws is crucial for the sustainable growth of this market.

Technological Limitations

While drone technology is advancing, limitations still exist. Issues such as battery life, payload capacity, and weather sensitivity can hinder drone performance in certain situations. Insurers need to address these technological hurdles to maximize the effectiveness of drones in their operations.

High Initial Investment

Although the costs of drone technology are decreasing, the initial investment can still be significant. Smaller insurance companies may struggle to justify the expenses associated with implementing drone solutions, potentially leading to a market divide.

Download Sample Report @ https://intentmarketresearch.com/request-sample/drones-for-insurance-market-3023.html

Future Trends in the Drones for Insurance Market

Integration with AI and Data Analytics

The future of drones in insurance lies in their integration with artificial intelligence (AI) and advanced data analytics. By combining drone-captured data with AI algorithms, insurers can gain deeper insights into risk assessment and improve predictive modeling, leading to more accurate underwriting practices.

Expanding Use Cases

As the technology evolves, insurers are likely to explore new applications for drones beyond property assessments. For instance, drones may be employed in agricultural insurance to monitor crop health or in life insurance to assess client risks in remote locations.

Improved Customer Engagement

Drones have the potential to enhance customer engagement through personalized experiences. For instance, insurers can use drones to create interactive policyholder videos, showcasing personalized risk assessments and providing insights that strengthen client relationships.

Conclusion

The Drones for Insurance Market is on a robust growth trajectory, driven by the need for efficiency and innovation in the insurance sector. As technology continues to evolve, and as insurers increasingly adopt drone solutions, we can expect transformative changes that enhance risk assessment, streamline claims processing, and improve customer satisfaction. The future looks bright for drones in insurance, and as the market expands, both insurers and policyholders stand to benefit.

FAQs

- What are the primary applications of drones in the insurance industry?

Drones are primarily used for risk assessment, claims processing, and gathering data for underwriting purposes. - How do drones improve claims processing speed?

Drones can quickly capture images and videos of damages, reducing the time required for inspections and accelerating the overall claims process. - What challenges do insurers face when implementing drone technology?

Key challenges include privacy concerns, technological limitations, and high initial investments. - How does regulatory support impact the use of drones in insurance?

Regulatory support provides a framework for insurers to use drones safely and legally, encouraging adoption and innovation. - What future trends can we expect in the drones for insurance market?

Future trends include the integration of AI and data analytics, expanding use cases beyond property assessments, and improved customer engagement strategies.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

sales@intentmarketresearch.com

US: +1 463-583-2713