The global enterprise video market was valued at USD 16.39 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 13.8% from 2022 to 2030. This growth can be largely attributed to the rising use of enterprise video solutions within organizations, aimed at enhancing collaboration among their global workforces. Enterprise video has become an essential component of content marketing strategies for many companies. Consequently, numerous organizations are now prioritizing the development of Content Delivery Networks (CDNs) to accelerate the delivery of multimedia internet content and improve video streaming capabilities. For example, in April 2022, Google Cloud launched its Media CDN, which allows businesses to utilize Google's extensive YouTube network. This service also includes additional features such as ecosystem integrations, custom ad insertion, and platform extensibility.

The market's expansion is further fueled by the increasing demand for on-demand video streaming for learning and development training across various organizations. On-demand videos provide employees with in-depth information that has been previously recorded by trainers, colleagues, and executives. Additionally, many businesses are utilizing enterprise video platforms for external activities such as sales, marketing, customer and partner training, and broadcasting public events.

Educational institutions are also increasingly adopting videos and multimedia presentations to enhance the learning experience, using visual recordings of webinars and courses. The growth in smartphone usage and the availability of high-speed internet have contributed to the rise of video content for educational purposes.

Gather more insights about the market drivers, restrains and growth of the Enterprise Video Market

Solution Insights

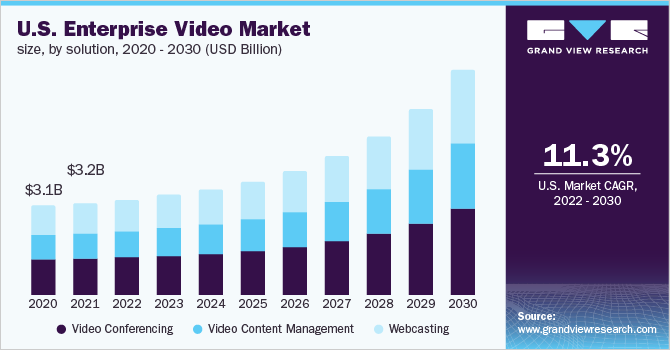

The video conferencing segment has established itself as a significant player in the overall enterprise video market, accounting for more than 40% of the revenue share in 2021. This substantial contribution can largely be attributed to the rising demand for video communication, which has been driven by the increasing geographical dispersion of business operations and the widespread adoption of remote working models. The COVID-19 pandemic acted as a catalyst, accelerating the shift towards virtual communication methods. As organizations adapted to new ways of working, there was a dramatic rise in the number of online workshops, conferences, and seminars. This shift not only heightened the demand for enterprise video solutions but also highlighted their critical role in maintaining business continuity and fostering collaboration among remote teams.

Furthermore, the expansion of the telemedicine industry has created additional opportunities for video conferencing solutions. As healthcare providers increasingly rely on virtual consultations to reach patients, the demand for high-quality video communication tools has surged. This trend is complemented by the rising penetration of online education globally, as educational institutions utilize video conferencing to facilitate learning. The integration of these technologies has paved the way for new growth opportunities, making the video conferencing segment a cornerstone of the enterprise video market.

In addition to video conferencing, the video content management segment is expected to witness significant growth, with an estimated compound annual growth rate (CAGR) of 13.6% during the forecast period. Video content management solutions are essential for businesses seeking to organize, store, and distribute their video and multimedia content effectively. As more organizations recognize the value of video as a communication tool, the need for efficient content management becomes increasingly crucial. The growing trend towards cloud-based content management systems is anticipated to further propel the expansion of this segment, allowing businesses to streamline their operations and enhance their digital presence.

Various companies focused on developing video content management software are actively collaborating to create innovative solutions that cater to evolving customer demands. Such partnerships are essential for addressing the challenges that businesses face in managing vast amounts of video content effectively. For instance, in February 2022, Brightcove Inc. made a strategic move by acquiring Wicket Labs, a company known for its audience insights capabilities. Wicket Labs specializes in providing analytics related to content and subscriber behavior, enabling users to make data-driven decisions. This acquisition is expected to enhance Brightcove's offerings by integrating advanced analytics into their video content management solutions, thereby improving conversion rates, subscriber acquisition, engagement, and retention.

The emphasis on data analytics in video content management reflects a broader trend within the industry: the need for actionable insights. As organizations invest in video communication tools, they are also seeking ways to measure the effectiveness of their content. This need for analytics-driven solutions is prompting companies to innovate continuously, ensuring that they can provide their clients with the tools necessary to succeed in an increasingly competitive digital landscape.

Order a free sample PDF of the Enterprise Video Market Intelligence Study, published by Grand View Research.