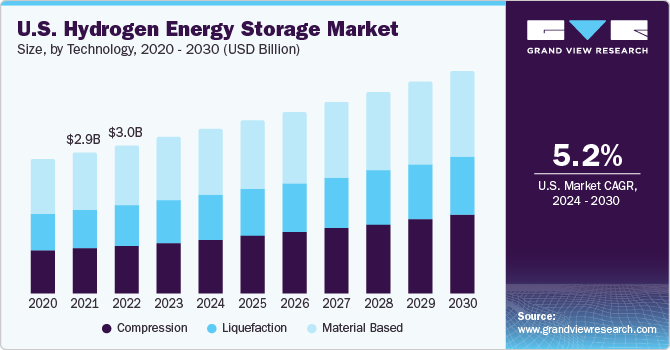

The global hydrogen energy storage market was estimated to be valued at approximately USD 15.97 billion in 2023, with expectations to expand at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. This growth is primarily driven by the rapid industrialization occurring in developing nations, coupled with a rising acceptance of alternative energy sources. Notably, the U.S. market is anticipated to experience significant growth during the forecast period, fueled by ongoing research and development initiatives and the construction of full-scale hydrogen storage projects. One such initiative is the Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST), spearheaded by the Fuel Cell Technologies Office, which focuses on existing and emerging technologies at national laboratories.

A key objective of the U.S. government is the development and establishment of cost-effective and energy-efficient hydrogen stations. These efforts are expected to further enhance market growth in the U.S. Additionally, the increasing applications of hydrogen across various industries are predicted to contribute to market expansion. Hydrogen is versatile and can be utilized in several ways: for industrial processes in oil refineries, as a power source in stationary fuel cells, as fuel in fuel cell vehicles, and stored in different forms such as cryogenic liquids, compressed gases, or loosely bonded hydride chemical compounds.

According to the International Renewable Energy Agency (IRENA), to ensure that renewable hydrogen is competitive with hydrogen produced from fossil fuels, it needs to be generated at a cost of less than USD 2.5 per kilogram. Several factors influence this cost, including the production location, market segment, renewable energy tariff rates, and potential future investments in electrolyzers. The increasing affordability of hydrogen production is expected to lead to a wider deployment of energy storage systems. Many participants in the hydrogen industry are also becoming more vertically integrated. The growing demand for stored hydrogen across various applications—including fuel cell vehicles, grid services, and telecommunications—is compelling market players to align their facilities with the needs of end-user industries.

Gather more insights about the market drivers, restrains and growth of the Hydrogen Energy Storage Market

Market Dynamics

Various government initiatives are underway to support the adoption of hydrogen as a fuel source. The European Commission has introduced a strategy aimed at advancing green hydrogen. This strategy includes the approval of green hydrogen production, which involves reforming hydrogen from natural gas while capturing carbon dioxide emissions through carbon capture and storage technologies. In 2020, Engie successfully completed a pilot test of its first renewable hydrogen passenger train in the Netherlands. The introduction of hydrogen-fueled trains is anticipated by 2024, with Engie collaborating with Alstom to expand this technology throughout the Netherlands. Following this success, there is potential for Engie to extend its hydrogen solutions to other countries, which would likely result in increased demand for hydrogen energy and its storage.

Despite these advancements, the slow development of distribution channels for transporting hydrogen in developing countries poses a significant challenge to market growth. Merchant distribution channels have yet to establish a strong presence in regions such as Africa and parts of the Middle East. The limited availability of hydrogen distributors in these areas has negatively impacted industrial expansion, thereby restricting the packaging and supply of industrial gases. Furthermore, an irregular and unpredictable supply of hydrogen can severely disrupt industries that rely on it, ultimately hindering the growth of numerous end-use sectors.

Order a free sample PDF of the Hydrogen Energy Storage Market Intelligence Study, published by Grand View Research.