The global cultured meat market was valued at approximately USD 246.9 million in 2022 and is poised for remarkable growth, with projections indicating a compound annual growth rate (CAGR) of 51.6% from 2023 to 2030. This substantial growth is primarily driven by advancements in technology within the alternative proteins sector, which is facilitating a shift toward more sustainable food systems worldwide. The increasing focus on meat substitutes and alternative proteins reflects a global response to the dual challenges of addressing meat shortages due to a burgeoning population and mitigating the environmental impact associated with traditional meat production.

Growing awareness surrounding environmental sustainability has played a crucial role in propelling the cultured meat industry forward. As concerns over climate change and resource depletion rise, the need for sustainable food sources has become paramount. Cultured meat, produced through cellular agriculture, offers a viable solution that reduces the environmental footprint of meat production, using significantly fewer resources such as land and water compared to conventional livestock farming.

The COVID-19 pandemic has had a profound impact on supply chains across various industries, including the cultivated meat sector. The lockdowns imposed globally disrupted many supply channels, which in turn affected the production of cultivated meat. One of the critical challenges faced was the procurement of necessary equipment, particularly bioreactors, which are vital for providing the optimal environment for cultivating animal cells. Trade barriers and shipping delays further exacerbated these challenges, leading to setbacks in production timelines.

Interestingly, during this same period, there was a surge in demand for bioreactors from the pharmaceutical industry, particularly for COVID-19 vaccine production. This heightened demand contributed to extended lead times for bioreactors, which are essential for both pharmaceutical and cultivated meat applications. Despite these challenges, the cultivated meat industry witnessed significant growth post-2020, especially in 2021, which emerged as a pivotal year marked by technological advancements, an increase in product launches, and a notable rise in investments and funding directed toward the sector.

Gather more insights about the market drivers, restrains and growth of the Cultured Meat Market

Source Insights and Market Segmentation

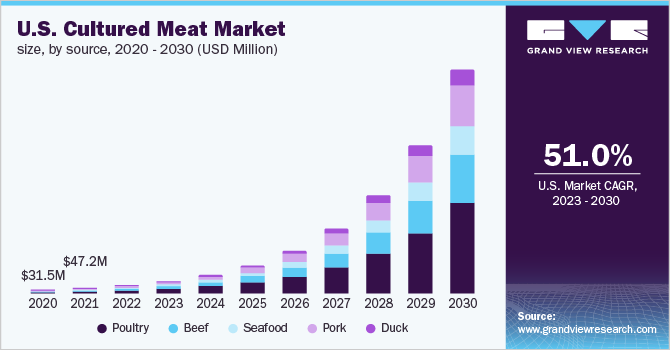

In terms of revenue, the poultry segment dominated the cultured meat market, capturing over 39% of the share in 2022. The popularity of chicken consumption in North America has seen substantial growth over the past 50 years, making it the most consumed meat in the United States. Annually, over 8 billion chickens are processed for food, and globally, more than 50 billion chickens are raised each year. This high level of consumption has prompted a wave of startups and new market entrants to invest in cellular agriculture technology, specifically targeting the development of poultry-cultivated products. These innovations are expected to further enhance the growth of the poultry segment, as consumers increasingly seek sustainable alternatives to traditional meat.

The pork segment is also anticipated to experience significant growth, projected to register a CAGR of 52.6% from 2023 to 2030. Classified as red meat by the United States Department of Agriculture (USDA), pork remains one of the most popular types of meat consumed globally. The demand for pork substitutes was notably intensified during the COVID-19 pandemic, which brought to light the vulnerabilities inherent in the traditional meat supply chain and the broader risks associated with reliance on animal agriculture. As consumers become more aware of these issues, the appeal of cultivated pork products has increased.

Moreover, the expansion of the pork segment can be attributed to the growing number of startups and established companies that are actively experimenting with cultivated meat derived from pig cells. This sector is not only innovating in terms of product development but also addressing consumer concerns about health, safety, and ethical considerations associated with conventional pork production.

Order a free sample PDF of the Cultured Meat Market Intelligence Study, published by Grand View Research.