The global defibrillators market is poised for significant growth, with an estimated size of USD 7.32 billion in 2023. Projections indicate a robust compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. Several factors are driving this upward trajectory, including increased product development initiatives, a rising incidence of sudden cardiac arrests, heightened awareness among the general public regarding cardiac health, and supportive measures from governments and healthcare organizations.

One noteworthy development occurred in May 2021, when Rapid Response Revival Research Ltd., an Australian firm, received a CE mark for its innovative CellAED. This device is recognized as the world’s first personal automated external defibrillator (AED) designed specifically for home use, which aligns with the company’s strategic objectives for growth. Such innovations reflect a broader trend of making defibrillation technology more accessible to the general populace, aiming to reduce the fatality rates associated with sudden cardiac events.

Another significant factor influencing the growth of the defibrillators market is the increasing global geriatric population. As individuals age, particularly those aged 65 and above, they become more susceptible to chronic diseases, notably cardiovascular diseases (CVDs). These conditions often necessitate the use of defibrillators to restore normal heart rhythms through electric shocks. A report published in November 2022, titled "Senior Population Statistics: A Portrait of Aging Americans," highlighted that approximately 54.1 million individuals in the United States, representing 16.3% of the population, are aged 65 years or older. This demographic trend underscores the growing demand for defibrillation devices, as healthcare systems strive to address the needs of an aging population.

Gather more insights about the market drivers, restrains and growth of the Defibrillators Market

Product Insights

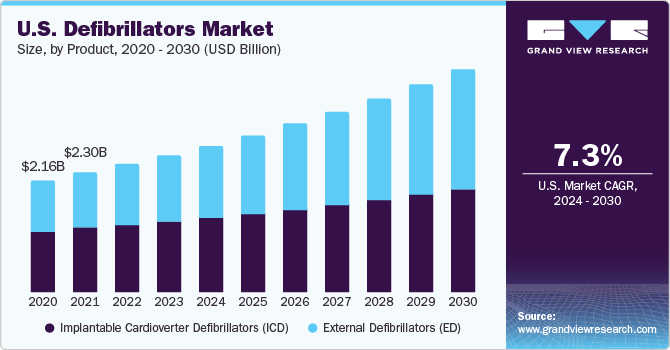

In terms of product segmentation, implantable cardioverter defibrillators (ICDs) held a dominant market share of over 52.03% in 2023. Several key factors contribute to the growth of this segment, including the increasing adoption of these devices driven by the high prevalence of CVDs, a substantial geriatric population in major markets, and ongoing improvements in product technology by leading companies. For instance, Boston Scientific initiated the MODULAR ATP clinical trial in December 2021 to evaluate the safety, performance, and efficacy of its mCRM Modular Therapy System. This system comprises two cardiac rhythm management devices: the EMBLEM MRI subcutaneous implantable defibrillator (S-ICD) system and another component. The trial aims to thoroughly assess the functionalities of this innovative system.

This strategic initiative highlights Boston Scientific's commitment to enhancing cardiac rhythm management technologies through rigorous clinical evaluations. Furthermore, the external defibrillators segment is anticipated to exhibit the fastest growth rate from 2024 to 2030. This growth can be attributed to technological advancements and initiatives designed to enhance access to automated external defibrillators (AEDs) in public spaces. For example, in March 2023, Safe Life made a strategic acquisition of Coro Medical and AED.us, a company specializing in AED sales and services. This move aims to expand the availability of life-saving equipment and services across the United States, ultimately improving emergency response capabilities.

Overall, the combination of an aging population, increasing cardiovascular health issues, and innovative product developments is driving the defibrillators market forward, positioning it for substantial growth in the coming years.

Order a free sample PDF of the Defibrillators Market Intelligence Study, published by Grand View Research.