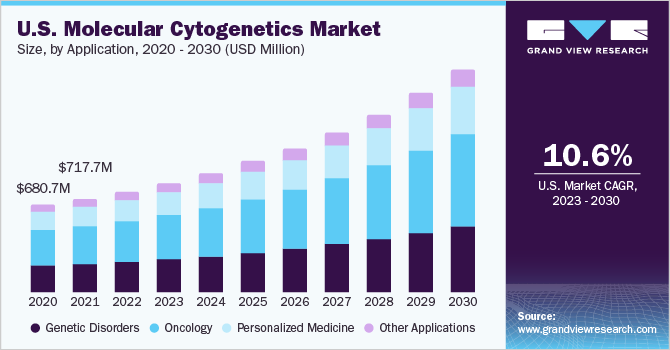

The global molecular cytogenetics market was valued at approximately USD 2.02 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 10.6% from 2023 to 2030. Several factors are driving this significant growth, including the rising incidence of oncology cases, advancements in chromosome analysis technologies, and a growing emphasis on personalized medicine. Additionally, the increasing frequency of workshops and conferences focused on cytogenetic analysis contributes to the market's momentum. For example, in April 2023, the University of Madras hosted a hands-on workshop that covered genomic techniques in clinical diagnostics, emphasizing the importance of cytogenetics.

As genomic data volumes continue to grow, the integration of multi-omics data along with the development of sophisticated bioinformatics tools and algorithms is creating a heightened demand for molecular cytogenetics. These advanced tools enable efficient management, analysis, and interpretation of large datasets, facilitating the discovery of significant associations between genetic alterations and disease phenotypes. Consequently, the expanding genomic repository is expected to be a catalyst for the molecular cytogenetics market throughout the forecast period.

Cancer remains a leading cause of mortality globally, responsible for nearly 10 million deaths in 2020. According to a World Health Organization (WHO) report published in February 2022, around 400,000 children are diagnosed with cancer each year. Molecular cytogenetics offers essential techniques for cytology, epigenetics, and genetic imaging, particularly the ability to detect chromosomal changes in cancer patients. Therefore, the increasing prevalence of cancer is likely to provide substantial opportunities for growth in the molecular cytogenetics market during the study period.

Gather more insights about the market drivers, restrains and growth of the Molecular Cytogenetics Market

Technology Insights

Within the molecular cytogenetics market, the comparative genomic hybridization (CGH) segment emerged as the leader, accounting for a significant revenue share of 36.5% in 2022. The advancement of CGH technology has markedly enhanced the resolution and sensitivity of chromosomal analyses. This technique allows for the detection of submicroscopic chromosomal alterations, such as deletions, duplications, amplifications, and copy number variations (CNVs), which may be undetectable through conventional cytogenetic methods.

Furthermore, array-based comparative genomic hybridization (aCGH) has accelerated the adoption of CGH technology, as it permits analysis of chromosomes extracted from tissue samples without the requirement for actively dividing cells. This capability signifies a major leap in technological advancements in molecular cytogenetics, and is expected to further boost growth in this segment during the forecast period.

The technology segment encompasses various methods, including comparative genomic hybridization, fluorescence in situ hybridization (FISH), immunohistochemistry, karyotyping, and others. Notably, the "other technologies" category is projected to experience the fastest CAGR over the coming years. Single-cell sequencing technologies have gained considerable traction recently, enabling the examination of individual cells and thereby facilitating the detection of genetic heterogeneity within tissues and tumor samples. Additionally, bioinformatics plays a vital role in the analysis and interpretation of the large-scale genomic data generated by technologies such as next-generation sequencing (NGS) and array-based platforms. The swift evolution of molecular cytogenetics is mirrored by the increasing demand for diverse technologies and comprehensive data analysis solutions, underscoring the sector's dynamic nature and growth potential.

Order a free sample PDF of the Molecular Cytogenetics Market Intelligence Study, published by Grand View Research.