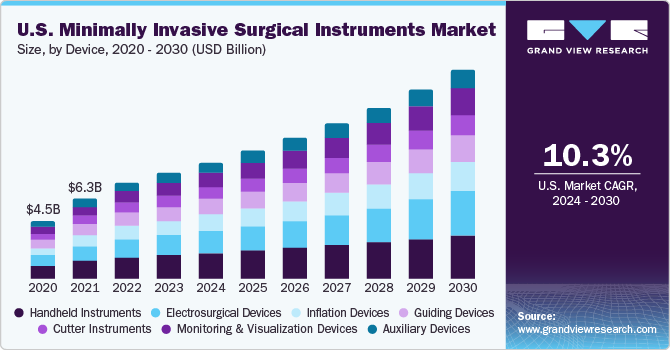

The global market for minimally invasive surgical instruments was valued at approximately USD 31.65 billion in 2023, and it is projected to experience a compound annual growth rate (CAGR) of 10.4% from 2024 to 2030. One of the primary drivers of this market growth is the introduction of surgical robots, which have significantly transformed the landscape of minimally invasive surgeries (MIS). Surgeons worldwide are increasingly accepting these technologies, as MIS procedures tend to be more cost-effective compared to traditional inpatient and open surgeries while yielding comparable, if not better, outcomes. This shift presents considerable benefits not only for patients but also for insurance providers, resulting in greater overall value.

This positive trend is expected to persist in the coming years. A surge in new product launches and a growing number of product approvals from various market participants are anticipated to create strong growth opportunities within the industry. For example, in December 2022, Abbott launched Navitor, an advanced transcatheter aortic valve implantation system that has broad applications in managing aortic stenosis, showcasing the innovative developments within the market.

Gather more insights about the market drivers, restrains and growth of the Minimally Invasive Surgical Instruments Market

Market Dynamics Insights

The advantages of minimally invasive surgical procedures in healthcare are numerous. These include reduced patient trauma and discomfort, a lower risk of infection, and shorter procedure and recovery times, which often lead to decreased healthcare costs. However, performing these specialized surgeries requires a highly skilled surgical team, trained in the use of specialized tools and equipment that provide limited visibility and range of motion. This encompasses a wide array of support equipment, including endoscopic cameras, visualization scanners, nonmagnetic monitoring devices, specialized catheters, contrast injectors, and sophisticated robotic systems.

Moreover, the benefits of minimally invasive surgeries over traditional open surgical techniques are expected to further drive market growth. The advantages include faster recovery times, smaller incisions, reduced scarring and pain, improved accuracy, and shorter hospital stays. Procedures such as radiofrequency (RF) ablation and laser ablation exemplify minimally invasive techniques. The rising demand for these surgical options is anticipated to support market growth throughout the forecast period. It is worth noting that the COVID-19 pandemic led to a significant decline in minimally invasive surgeries in 2020, as fewer screening initiatives were conducted, resulting in a drop in newly diagnosed cancer cases.

The market is continuously evolving due to ongoing innovations, particularly in cardiac, orthopedic, ophthalmic, neurological, and oral surgical fields. Continuous advancements in technology provide higher-quality instruments, enabling surgeons to perform surgical interventions more effectively while maintaining patient safety. Enhanced product designs improve accuracy and control within the operating room. Notably, the prevalence of heart disorders is on the rise globally, driven by factors such as sedentary lifestyles, increasing obesity rates, smoking, poor nutrition, and genetic predisposition.

Other contributing risk factors include diabetes, hypertension, and hyperlipidemia. According to data from the CDC, approximately 20.1 million adults aged 20 and older were diagnosed with coronary artery disease in 2020. Individuals aged 60 and above are particularly susceptible to cardiovascular, orthopedic, and neurological conditions. As the geriatric population increases, so too is the expected demand for surgical instruments. Additionally, a rise in road accidents is a significant factor contributing to the need for surgical equipment. The growing volume of orthopedic surgeries globally is also driving demand for minimally invasive surgical instruments.

For instance, data from the American Academy of Orthopedic Surgeons indicates that primary hip surgeries accounted for 32.7% and primary knee surgeries for 54.4% of all orthopedic procedures performed in 2019. This rising prevalence of targeted diseases is likely to create ample growth opportunities for industry players. Technological advancements aimed at improving the accuracy, portability, and cost-effectiveness of MIS instruments are compelling market participants to continually enhance and introduce advanced devices. The development of novel MIS tools has made it possible to perform complex procedures that were previously deemed unsuitable for minimally invasive techniques.

Order a free sample PDF of the Minimally Invasive Surgical Instruments Market Intelligence Study, published by Grand View Research.