The global antimicrobial additives market was valued at USD 3.11 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. This growth is expected to be driven by several factors, including the rapidly growing population, urbanization, and heightened health awareness, especially in emerging economies in the Asia-Pacific region. These factors are likely to support various end-use industries, resulting in an increased demand for antimicrobial additives during the forecast period.

The demand for antimicrobial additives is anticipated to rise primarily in the healthcare and packaging sectors. This is largely due to the growing need for products that can help address global health concerns, such as the COVID-19 pandemic. The increased production and consumption of healthcare and packaging products designed to combat the spread of the virus will positively influence the antimicrobial additives market, particularly in the plastics segment. In addition, the Asia-Pacific region is expected to lead the demand for antimicrobial additives, owing to its significant presence of healthcare product manufacturers.

Within the antimicrobial additives market, the healthcare segment has seen the highest level of penetration, accounting for the largest share of revenue. This can be attributed to the strong demand for antimicrobial additives used in the production of infection-preventing and sterilized medical products, such as surgical tubing, cables, and orthopedic sutures. Furthermore, the growing health consciousness among consumers, the increasing elderly population in countries like Japan, China, and the U.S., and the rising demand for high-quality medical equipment are expected to further drive the market for antimicrobial additives.

Gather more insights about the market drivers, restrains and growth of the Antimicrobial Additives Market

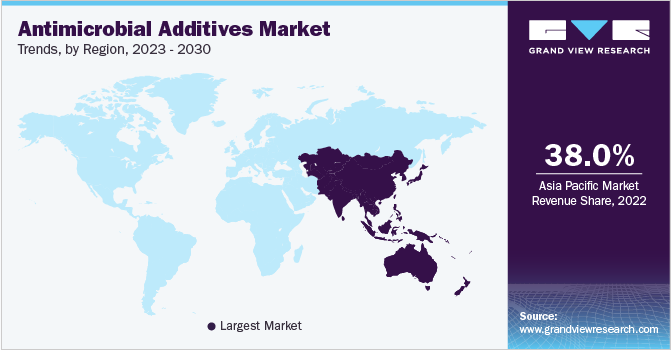

Regional Insights: Antimicrobial Additives Market

Asia Pacific

Asia Pacific holds the dominant position in the global antimicrobial additives market, contributing over 38.0% to the total global revenue in 2023. This significant market share is driven by the robust growth of key end-use industries such as automotive, healthcare, construction, food and beverage, and packaging. Several factors are contributing to the expansion of antimicrobial additives in this region:

1. Automotive Industry:

The automotive industry in countries like China, Japan, and India is a major factor propelling market growth. These countries have strong manufacturing bases for vehicles, and the increasing sales of passenger vehicles are expected to further boost the demand for antimicrobial additives in automotive applications. In particular, antimicrobial additives are utilized in vehicle interiors, seat fabrics, and other components to improve hygiene and prevent microbial growth.

Additionally, favorable government policies, such as foreign direct investments (FDI) and the Make in India initiative in India, are expected to provide ample growth opportunities for the automobile industry. This, in turn, will likely increase the consumption of antimicrobial additives in the region.

2. Industrial Expansion:

The industrialization across Asia Pacific is another key driver. The growing demand for industrial machinery, equipment, and containers is expected to augment the use of antimicrobial additives in these sectors. As industries expand, antimicrobial additives are increasingly applied to prevent microbial contamination in various industrial applications.

3. Construction and Infrastructure:

The construction industry in emerging economies such as India and China is expanding rapidly. Both governments have been significantly increasing infrastructure spending, creating new opportunities for antimicrobial additives in building materials, paints, and coatings. These additives are often used in construction materials to enhance the durability and hygiene of buildings and infrastructure.

4. Healthcare Sector:

The healthcare segment is a major driver of antimicrobial additive demand in Asia Pacific. The growing demand for syringes, surgical drapes, personal protective clothing (PPE), and other medical products that require antimicrobial properties to prevent infections is pushing up consumption. The pandemic increased the demand for such products, and the market for these healthcare items is expected to remain strong as the region recovers from COVID-19.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global self-healing polymers market size was estimated at USD 1.57 billion in 2023 and is expected to grow at a CAGR of 26.18% from 2024 to 2030.

• The global styrene butadiene rubber market size was valued at USD 46.46 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030.

Key Antimicrobial Additives Companies

Several prominent companies are leading the antimicrobial additives market in Asia Pacific, leveraging both organic and inorganic strategies such as capacity expansion, mergers & acquisitions, and joint ventures to expand their market share. These companies focus on innovation and new product developments to cater to the growing demand in various industries.

For example, in March 2023, IFF, a renowned player in the food and beverage sector, announced a strategic partnership with Grupo Drul to distribute FermaSure XL in Brazil, signaling the importance of market expansion and strategic alliances to tap into new regions.

The following are the key companies driving growth in the antimicrobial additives market:

• NanoBioMatters Industries S.L.

• BASF SE

• RTP Company

• Milliken Chemical

• BioCote Limited

• Microban International

• Clariant AG

• PolyOne Corporation

• Momentive Performance Materials Inc.

• Life Materials Technologies Limited

• SteriTouch Limited

• Sanitized AG

• Dow Inc.

• LyondellBasell Industries Holdings B.V.

• Plastics Color Corporation

• Lonza

Order a free sample PDF of the Antimicrobial Additives Market Intelligence Study, published by Grand View Research.