The global minimally invasive surgical instruments market was valued at USD 31.65 billion in 2023 and is projected to experience substantial growth, with an anticipated compound annual growth rate (CAGR) of 10.4% from 2024 to 2030. This growth is primarily driven by the increasing adoption of minimally invasive surgeries (MIS) and the continuous advancements in surgical technology, particularly the use of surgical robots. These robots have significantly transformed the landscape of MIS, offering enhanced precision, flexibility, and control during procedures. The global acceptance of surgical robots is rapidly growing, with more surgeons incorporating robotic assistance into their practices due to the advantages they offer.

One of the key factors propelling the growth of the MIS market is the cost-effectiveness of these procedures compared to traditional in-patient and open surgeries. MIS typically results in lower hospitalization costs, shorter recovery times, and reduced risk of complications, all of which contribute to lower overall healthcare expenses. Importantly, MIS procedures yield comparable or even better clinical outcomes compared to traditional methods, which enhances their appeal to both patients and insurance providers. As a result, insurance companies are increasingly supporting MIS due to the cost-saving potential, further driving the market's growth.

This trend is expected to continue over the coming years, as more healthcare providers adopt minimally invasive techniques, and as patients increasingly seek out these procedures for their reduced recovery times and overall lower costs. The ongoing development of advanced surgical technologies and instruments is also likely to contribute to the market’s expansion, as these innovations improve the quality and accessibility of MIS procedures.

Gather more insights about the market drivers, restrains and growth of the Minimally Invasive Surgical Instruments market

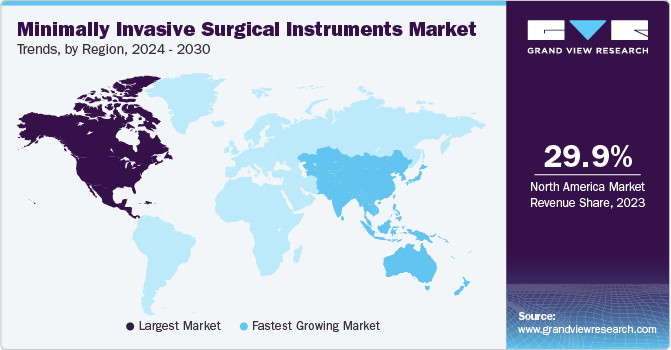

Regional Insights

North America

North America led the minimally invasive surgical instruments market in 2023, commanding a significant market share of 29.9%. Several factors contribute to North America's dominance in the market, including the region's well-established healthcare infrastructure, favorable government reimbursement policies, and the high prevalence of chronic diseases. The strong healthcare systems in countries like the U.S. and Canada ensure wide access to advanced medical treatments, including minimally invasive procedures. Additionally, healthcare policies in these countries increasingly support minimally invasive surgeries due to their cost-effectiveness, reduced recovery times, and improved patient outcomes, which further strengthens the market.

Asia Pacific

On the other hand, Asia Pacific is projected to experience the fastest compound annual growth rate (CAGR) of 10.8% from 2024 to 2030. Several factors are driving this robust growth in the region, including the improvement of healthcare infrastructure and a growing focus on healthcare initiatives by regional governments. Countries such as India and Japan are key players in this growth, driven by significant economic development, which has boosted access to medical technology and healthcare services.

The Asia Pacific region is also characterized by a large population base, many of whom have lower per capita income levels. As a result, there is a high demand for affordable treatment options, particularly minimally invasive procedures, which tend to be less expensive than traditional open surgeries. This demand for cost-effective healthcare solutions is further fueling the market’s expansion.

Moreover, multinational companies are increasingly focusing on expanding their presence in emerging markets like India and China. These countries are seeing significant investments in their healthcare sectors, and as a result, many global companies are forming strategic partnerships and alliances with local entities to strengthen their market positions. These collaborations help provide the necessary infrastructure and distribution networks to reach larger segments of the population. As more companies enter these markets, the overall growth potential in the region continues to rise, creating lucrative opportunities for industry players.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global surgical robots market size was estimated at USD 3.92 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030.

• The global ambulatory surgery centers market size was estimated at USD 134.95 billion in 2023 and is expected to expand at a CAGR of 6.25% during the forecast period.

Key Companies & Market Share Insights

The minimally invasive surgical instruments market is characterized by the presence of leading companies that have forged strong collaborations with manufacturers and suppliers to ensure a steady global supply of products. Many of these companies are also actively pursuing strategic partnerships and mergers and acquisitions as part of their growth strategies, aiming to expand their global footprint and enhance their product offerings.

For instance, in February 2023, Encision Inc. entered into a Proof of Concept Services Agreement with Vicarious Surgical Inc.. This partnership aims to advance the development of the Vicarious surgical robot, which is designed to enhance precision, control, and visualization in robotic-assisted minimally invasive surgery. The collaboration is expected to drive innovation in the surgical robotics segment, offering greater benefits to surgeons and patients alike by improving the accuracy and effectiveness of minimally invasive procedures.

Key Minimally Invasive Surgical Instruments Companies

The minimally invasive surgical instruments market features several prominent companies that dominate the industry, influencing trends and innovations. These key players have a substantial market share and are recognized for their expertise in providing cutting-edge medical instruments and solutions. Some of the major companies operating in the market include:

• Medtronic

• Siemens Healthineers AG

• Ethicon, Inc. (Johnson & Johnson)

• Depuy Synthes

• GE Healthcare

• Abbott Laboratories

• Intuitive Surgical, Inc.

• NuVasive, Inc.

• Zimmer Biomet

Order a free sample PDF of the Minimally Invasive Surgical Instruments Market Intelligence Study, published by Grand View Research.