The global laboratory proficiency testing (PT) market was valued at USD 1.36 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Several key factors are expected to drive the growth of this market, including an increasing focus on water testing, the legalization of medical cannabis, the rise in the number of cannabis testing laboratories, the growing incidence of foodborne illnesses, the increasing cases of chemical contamination in food, and the continuous introduction of new products and services within the sector.

A notable example of innovation in the field is the launch of BIPEA's Proficiency Testing Scheme (PT 35d) in March 2022, which is specifically designed for water microbiological testing laboratories. This new scheme reflects the growing importance of accurate and reliable testing in various sectors, particularly in environmental and public health fields. Furthermore, the adoption of laboratory proficiency testing is being further accelerated by stringent regulations that require laboratories to meet specific performance standards, driving the market's growth in the coming years.

Another factor contributing to the expansion of the laboratory PT market is the use of proficiency testing in more specialized applications. For example, PT is increasingly used to assess the age of groundwater by measuring tritium levels, which helps in mapping aquifer reserves and determining their vulnerability to surface pollution. According to the International Atomic Energy Agency (IAEA), of the 78 laboratories conducting tritium testing globally, half meet the required analytical testing standards. The IAEA and other organizations play a critical role in assisting laboratories with ensuring the accuracy and calibration of their instruments, as well as verifying their overall performance. In September 2020, the IAEA conducted training for laboratories on tritium testing and interpreting related data, further supporting the integration of proficiency testing into these critical environmental assessments.

Gather more insights about the market drivers, restrains and growth of the Laboratory Proficiency Testing Market

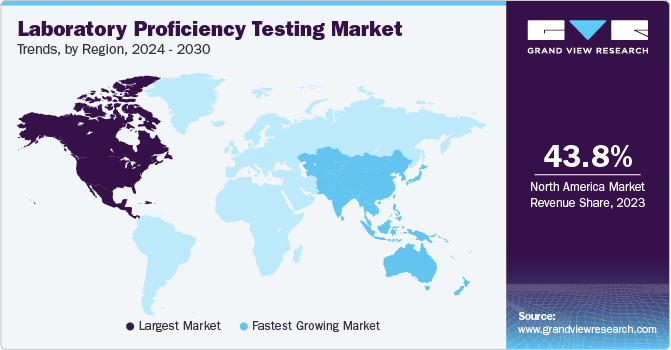

Regional Insights

North America

North America held a dominant share of the laboratory proficiency testing (PT) market, accounting for 43.78% of the revenue in 2023. This significant market share can be attributed to the region's advanced healthcare system and high adoption rate of proficiency testing across various sectors. The well-established regulatory framework in North America places a strong emphasis on quality management, which encourages laboratories to implement rigorous testing standards to comply with regulations. This focus on maintaining high-quality standards is a key driver for the market's growth. Additionally, the wide availability of PT programs in North America ensures that laboratories across different industries have access to the resources they need to verify their testing accuracy and competence.

The increasing stringency of environmental regulations, particularly concerning water safety and environmental protection, also plays a crucial role in driving demand for laboratory proficiency testing. As North America continues to prioritize environmental sustainability, the need for accurate and reliable laboratory testing to monitor water quality and other environmental factors has become more pronounced. These factors collectively contribute to the continued expansion of the laboratory PT market in North America.

Asia Pacific

In contrast, the Asia Pacific region is expected to experience the fastest growth in the laboratory proficiency testing market over the forecast period. Several key factors are driving this rapid expansion. First, there is an increasing awareness of healthcare and the growing importance of ensuring the accuracy and reliability of medical and clinical laboratory tests. As healthcare standards improve across the region, more laboratories are seeking international accreditations to meet global testing standards, further boosting the demand for proficiency testing.

In addition to the healthcare sector, Asia Pacific is becoming a central hub for biopharmaceutical and pharmaceutical companies, largely due to its low labor costs and the region's ability to produce high-quality products at competitive prices. As these industries expand, there is a greater emphasis on continuous laboratory testing of raw materials, finished products, and microbial cultures for production. This rigorous testing is essential not only for quality control but also for obtaining approvals from regulatory bodies such as the U.S. Food and Drug Administration (FDA). Therefore, the demand for laboratory proficiency testing is expected to grow significantly as companies in the region seek to meet the required standards for product approval and quality assurance in both domestic and international markets.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

• The global cholesterol testing products and services market size was estimated at USD 19.85 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030.

• The global personalized medicine biomarkers market size was estimated at USD 21.88 billion in 2024 and is anticipated to grow at a CAGR of 13.6% from 2025 to 2030.

Key Companies & Market Share Insights

Key market players are adopting market strategies, such as new product launches, collaborations, and geographical expansions, to increase their global footprint.

• In April 2023, BIPEAunveiled PTS 110A, a new Proficiency Testing Scheme that enables testing laboratories to assess their analytical capabilities by analyzing a rice sample. This initiative can empower laboratories to evaluate and enhance their performance in rice sample analysis, driving excellence in the field.

• In January 2023, BIPEA introduced a novel proficiency test in surface microbiology, expanding its range of offerings. This new test allows professionals in the field to enhance their expertise and proficiency in surface microbiology analysis.

Key Laboratory Proficiency Testing Companies:

• LGC Limited

• Bio-Rad Laboratories, Inc.

• Randox Laboratories Ltd.

• QACS - The Challenge Test Laboratory

• Merck KGaA

• Weqas

• BIPEA

• NSI Lab Solutions

• Absolute Standards, Inc.

• INSTAND

Order a free sample PDF of the Laboratory Proficiency Testing Market Intelligence Study, published by Grand View Research.