The global Asset Performance Management (APM) market was valued at USD 19.32 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. This substantial growth is driven by the increasing demand for digital solutions across a wide range of industries, including oil & gas, manufacturing, chemical, and others, which are seeking to optimize their operations and reduce operational expenses.

APM systems play a crucial role in asset management by collecting diverse data from a variety of assets, such as machinery, heavy equipment, and other industrial assets, through the use of sensors. These systems integrate data from disparate sources, creating a centralized data analytics platform that provides a comprehensive view of all operational assets. By analyzing this data, businesses can gain valuable insights that help improve asset management processes, prioritize maintenance activities, and ultimately enhance overall operational efficiency.

The growing adoption of APM systems is further fueled by their integration with complementary technologies, such as mobile solutions and geographic information systems (GIS). This integration enables more efficient use cases for the systems, allowing businesses to enhance their asset management strategies across multiple platforms. As a result, the market is seeing steady growth as organizations seek to capitalize on the enhanced capabilities offered by these integrated systems.

Additionally, APM systems are leveraging the power of the Industrial Internet of Things (IIoT) to improve equipment reliability. Since ensuring the reliability of equipment is a fundamental aspect of asset performance management, industries are increasingly drawn to APM systems that utilize IIoT technologies to monitor and maintain the health of their equipment. This further drives the demand for APM systems, particularly within the industrial sector, as companies look to improve equipment uptime, reduce maintenance costs, and prevent potential failures that could lead to costly downtime.

Gather more insights about the market drivers, restrains and growth of the Asset Performance Management Market

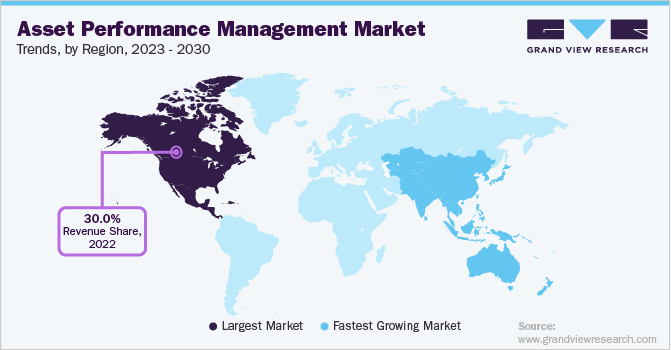

Regional Insights

North America dominated the global asset performance management (APM) market with a share of over 30.0% in 2022. This dominance is primarily driven by the region's increasing demand for high-speed data networks and the significant presence of software vendors. These factors contribute to the growth of the regional market, as companies in North America are heavily investing in IT infrastructure, particularly in the research and development (R&D) of cloud infrastructure. These investments fuel the expansion of APM solutions, as organizations seek more efficient ways to manage and optimize their assets.

One of the key drivers of growth in North America is the favorable business environment and supportive government policies, which help companies innovate and deploy advanced cloud-based solutions. These conditions have allowed businesses to develop and launch improved cloud platforms, which in turn increase the adoption of asset performance management (APM) systems. The region also benefits from a high concentration of computer scientists, data analysts, and software engineers in countries like Canada, who are increasingly leveraging cloud-based solutions and services. This talent pool further accelerates the development and implementation of APM technologies, contributing significantly to the region’s market growth.

Asia Pacific

Asia Pacific is expected to register the highest CAGR during the forecast period, driven by substantial investments from large firms and the implementation of new technologies across various industries and enterprises. Many companies in this region are migrating their workloads to the cloud as part of their ongoing digital transformation efforts. As a result, the adoption of cloud-based solutions, including APM systems, is rising, and this shift is expected to fuel growth in the regional market.

In addition, growing investments in IT infrastructure development by major tech giants are likely to provide numerous opportunities for stakeholders in the APM market. These investments will not only improve the infrastructure but also contribute to the development and adoption of more advanced asset management solutions.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global geographic information system market size was valued at USD 9.80 billion in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030.

• The global digital twin market size was estimated at USD 16.75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 35.7% from 2024 to 2030.

Key Companies & Market Share Insights

The APM market is highly competitive, with numerous players operating on a global scale. As organizations increasingly focus on improving asset performance, maintaining equipment health, and reducing time to market, there is a rising demand for advanced APM solutions. This demand is encouraging vendors to innovate and introduce new systems that better meet the needs of businesses.

To stay competitive, market players are expanding the capabilities of APM systems by integrating complementary technologies such as artificial intelligence (AI), machine learning (ML), mobility solutions, geographic information systems (GIS), augmented reality (AR), virtual reality (VR), and mixed reality (MR). These technological integrations enable APM systems to become more intelligent, predictive, and adaptable to changing business environments. In particular, the growing use of cloud-based APM solutions and predictive analytics is transforming the way companies monitor and maintain their assets.

The increasing need for mobility and data portability is also driving the demand for data-centric solutions, which in turn fuels the growth of the APM market. With the rising reliance on data for decision-making, companies are investing in APM systems that can offer real-time insights, predictive capabilities, and improved operational efficiency.

Some prominent players in global asset performance management market include:

• ABB Ltd

• Aspen Technology, Inc.

• AVEVA Group plc

• Bentley Systems, Incorporated

• DNV GLAS

• GE Digital

• International Business Machines Corporation

• Rockwell Automation

• SAP SE

• SAS Institute, Inc.

• Siemens Energy

Order a free sample PDF of the Asset Performance Management Market Intelligence Study, published by Grand View Research.