The global wearable injectors market was valued at USD 8.80 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.11% from 2024 to 2030. Several key factors are driving this robust growth, particularly the rising prevalence of chronic illnesses, the aging population, and the increasing awareness surrounding needle stick injuries.

Wearable injectors are becoming increasingly popular due to their advantages over other medication delivery methods. These devices offer a cost-effective alternative to traditional injection systems, which is especially attractive in a healthcare landscape that is focused on reducing costs. Additionally, wearable injectors support continuous monitoring and home-based treatments, addressing the growing demand for more patient-centered care. This shift towards home care and remote monitoring, particularly among patients with chronic conditions, is expected to fuel market demand.

One of the major driving forces behind the adoption of wearable injectors is the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and autoimmune disorders. As these diseases become more widespread, especially in aging populations, the demand for efficient, convenient, and non-invasive drug delivery systems like wearable injectors has surged. Additionally, wearable injectors align with the increasing focus on providing care in the home setting, enabling patients to self-administer their medications with minimal supervision.

The aging population is another significant contributor to the market's growth. As the number of elderly people continues to rise globally, the incidence of chronic health conditions and the need for frequent medication administration also increases. Wearable injectors offer a solution that not only allows for continuous medication delivery but also improves patients' quality of life by reducing hospital visits and healthcare interventions.

Gather more insights about the market drivers, restrains and growth of the Wearable Injectors Market

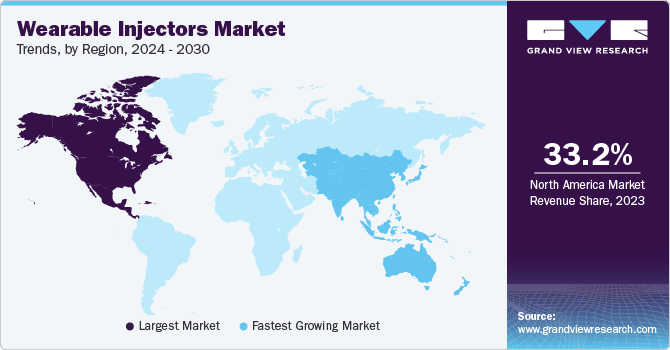

Regional Insights

North America

The North American market dominated the global wearable injectors market, accounting for the largest revenue share of 33.2% in 2023. This strong market position is primarily driven by the rising prevalence of chronic diseases and lifestyle-related health conditions such as diabetes, heart disease, and obesity, which are increasingly common in the region. Additionally, enhanced healthcare infrastructure and widespread access to advanced medical technologies have further bolstered the adoption of wearable injectors. For instance, according to the CDC, approximately 37 million Americans suffer from diabetes, with 90 to 95% of these cases being type 2 diabetes. As the number of chronic disease patients continues to rise, the demand for continuous and self-administered treatment options, such as wearable injectors, is expected to grow significantly in North America.

Asia Pacific

In Asia Pacific, the market for wearable injectors is anticipated to grow at an impressive CAGR of 18.45% during the forecast period. This rapid growth is attributed to several key factors. Firstly, favorable government initiatives in the region are encouraging the adoption of medical technologies like wearable injectors, driven by an increasing geriatric population and growing healthcare expenditure. As populations age, the demand for more efficient, non-invasive drug delivery systems increases, particularly in countries like Japan, China, and India, where aging demographics are prominent. Additionally, rising awareness about wearable injectors among healthcare professionals and patients is further contributing to market growth. The combination of government support, economic development, and a growing focus on healthcare solutions is positioning Asia Pacific as a high-growth region for wearable injectors in the coming years.

Browse through Grand View Research's Medical Devices Industry Research Reports.

• The global automated suturing devices market size was valued at USD 3.63 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.3 % from 2024 to 2030.

• The US laboratory disposable products market size was valued at USD 1.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030.

Key Companies & Market Share Insights

The global wearable injectors market is highly fragmented, with significant competition from a wide range of established players. These companies are continuously seeking ways to expand their market share by adopting growth strategies such as new product launches, collaborations, partnerships, operational expansion, and mergers & acquisitions. Additionally, many players are focusing on patient awareness campaigns to educate both consumers and healthcare professionals about the benefits of wearable injectors in managing chronic conditions.

For example, in March 2021, Aptar and Noble International collaborated with dne pharma, a leading company in Northern European addiction treatment, to launch the Unidose Liquid System. This collaboration was aimed at helping prevent opioid overdoses in Europe, a significant public health issue. The Unidose Liquid System was developed through a partnership between Ventizolve, Aptar, and Noble, demonstrating the growing use of wearable injectors in critical care settings, such as addiction treatment.

In addition to collaborations, many biopharmaceutical companies are actively exploring the use of wearable injectors to deliver their biological drugs more efficiently. These injectors offer a suitable solution for drugs that require precise, controlled delivery over extended periods. For instance, in January 2023, Tandem Diabetes Care, Inc. acquired AMF Medical SA, the manufacturer of the Sigi Patch Pump, which is a wearable insulin pump for diabetes management. This acquisition highlights the growing interest in wearable injectors in the diabetes care sector.

Key wearable injectors Companies:

• BD

• Johnson & Johnson Services, Inc.

• F. Hoffmann-La Roche Ltd.

• Unilife Corporation

• Steady Med Therapeutics, Inc.

• Amgen Inc.

• Insulet Corporation

• Enable Injections

• West Pharmaceutical Services, Inc.

• CeQur Simplicity

Order a free sample PDF of the Wearable Injectors Market Intelligence Study, published by Grand View Research.