The global market for advanced driver assistance systems (ADAS) was valued at approximately USD 30.61 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030. This notable growth is largely driven by an increasing demand for ADAS in compact passenger vehicles, as more consumers prioritize safety and convenience features. Additionally, government regulations mandating the implementation of ADAS in vehicles are expected to further bolster market demand. Factors such as rising disposable incomes, greater economic stability, and a growing inclination toward materialistic lifestyles are also contributing to an uptick in luxury vehicle sales globally.

In developed nations like the United States, Canada, Japan, Spain, South Korea, and Germany, a significant proportion of luxury car ownership is observed. However, emerging markets, particularly India and China, have recently experienced a surge in luxury car sales. Germany stands out as the most lucrative market for luxury vehicles, hosting major manufacturers such as BMW, Mercedes-Benz, Audi AG, and Volkswagen. Additionally, Germany is recognized as the largest exporter of luxury cars, with the United States being one of the foremost consumer markets for various luxury vehicle types.

The increasing demand for sophisticated systems—including road sign recognition systems, night vision capabilities, and drowsiness monitoring technologies—is anticipated to influence market growth significantly in the coming years. Moreover, the need for traditional ADAS features, such as autonomous emergency braking and adaptive cruise control systems, is expected to escalate markedly due to heightened government regulations aimed at enhancing road safety and minimizing accidents. For instance, the European Union (EU) enacted legislation mandating the inclusion of adaptive cruise control systems in all heavy commercial vehicles by 2020. Such regulations are expected to create lucrative growth opportunities for the ADAS market throughout the forecast period.

Gather more insights about the market drivers, restrains and growth of the Advanced Driver Assistance Systems Market

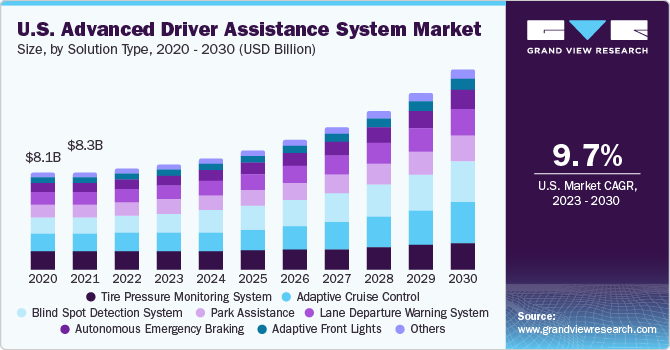

Solution Type Insights

In 2022, the adaptive cruise control (ACC) segment emerged as the leading player in the market, commanding an impressive market share of 19.7%. This significant dominance can be attributed to a confluence of factors, primarily the heightened demand for advanced safety features in vehicles. As consumers become more aware of the importance of safety on the road, manufacturers are responding by integrating more sophisticated technologies into their vehicles. ACC systems, which automatically adjust a vehicle's speed to maintain a safe distance from the car ahead, are a prime example of this trend.

Technological advancements have played a pivotal role in the growth of the ACC segment. Innovations in sensor and radar technology have enabled these systems to operate more effectively and reliably. As a result, consumers are increasingly inclined to choose vehicles equipped with ACC, driven by the desire for enhanced driving comfort and safety. Additionally, government regulations are influencing this trend, as many jurisdictions are now mandating the inclusion of ACC systems in certain types of vehicles, particularly commercial ones. This regulatory push further solidifies the ACC segment's position in the market.

On the other hand, the blind spot detection system (BSD) segment is projected to experience the fastest compound annual growth rate (CAGR) of 13.4% throughout the forecast period. BSD systems are designed to monitor the areas adjacent to a vehicle that are typically not visible to the driver, commonly known as blind spots. By utilizing a network of sensors, these systems detect the presence of other vehicles in these hard-to-see areas and alert the driver through visual or audible warnings. This feature is crucial in preventing accidents that could occur when a driver attempts to change lanes without adequately checking their surroundings.

The growth of the BSD segment is fueled not only by the increasing demand for safety features but also by notable technological advancements that have made these systems more accessible and reliable. Over recent years, the cost of implementing BSD technology has decreased, making it a more feasible option for a broader range of vehicles. This affordability, combined with a growing consumer awareness of safety issues, is driving up the adoption of BSD systems.

Moreover, as automobile manufacturers continue to invest in research and development, the capabilities of BSD systems are becoming more sophisticated. Modern BSD systems may now incorporate additional features such as rear cross-traffic alerts, which warn drivers of approaching vehicles when reversing out of parking spaces. These advancements further enhance the safety benefits provided by BSD systems, making them increasingly attractive to consumers.

Order a free sample PDF of the Advanced Driver Assistance Systems Market Intelligence Study, published by Grand View Research.